Wanda "sold" again: Wang Jianlin transfers 49% stake in Beijing Wanda Investment

Wang Jianlin made another move!

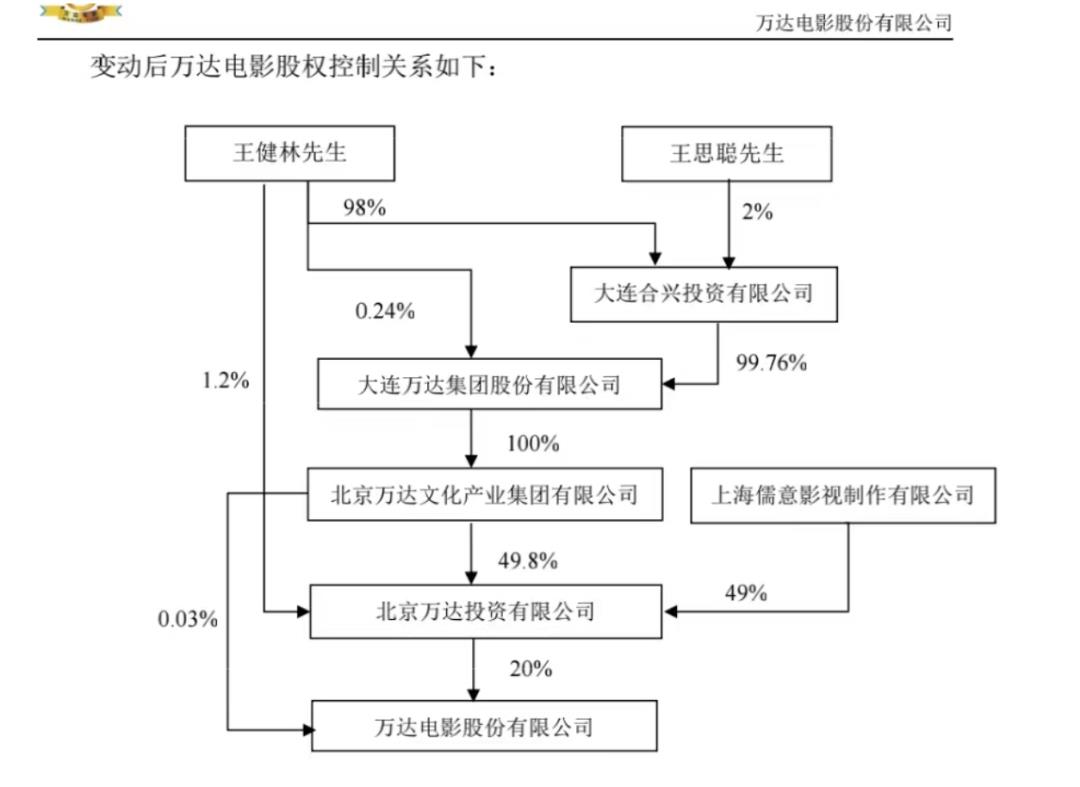

According to the announcement on the evening of July 23, the shareholders of Beijing Wanda Investment Co., Ltd. (referred to as "Beijing Wanda Investment") changed, and the 49% stake of Wanda Investment was transferred to Shanghai Ruyi Film and Television Production Co., Ltd. (referred to as "Shanghai Ruyi").

Wang Jianlin’s transfer of a 49% stake in Beijing Wanda’s investment topped the hot search list.

This is the third time Wang Jianlin has sold assets since July. When the domestic film and television market is recovering, why did Wanda choose to sell the equity of Beijing Wanda Investment Company?

Wanda, which is on the cusp of the trend, has made a big move to sell assets.

People familiar with the matter told Surging News that the Wanda Group will use the funds sold to repay the principal of the $400 million debt due on July 23.

According to the announcement, on the evening of the 23rd, the consideration for this transaction surfaced. China Ruyi announced that on July 20, Shanghai Ruyi (the company’s controlled structural entity), as the transferee, entered into an equity transfer agreement with Beijing Wanda Cultural Industry Group Co., Ltd. to transfer its 49% stake in Beijing Wanda Investment Co., Ltd. for 2.262 billion yuan.

Before the transfer, Wang Jianlin and Wanda Group’s Beijing Wanda Cultural Industry Group Co., Ltd. jointly owned all the shares of Beijing Wanda Investment. After the transfer, Beijing Wanda Investment will be held 49.8% by Wanda Cultural Industry Group, 49% by Shanghai Ruyi, and 1.2% by Wang Jianlin.

Upon completion of the share transfer, Shanghai Ruyi will directly hold a 49% stake in Beitou. "Shanghai Ruyi currently has no intention of appointing directors to Beitou and has no intention of participating in its daily operation and management. Beitou will not be a subsidiary of the company and its financial results will not be consolidated into the company’s consolidated financial statements," China Ruyi said.

Analysts said that this time Ruyi Film and Television is willing to invest in Wanda Investment because of its stake in Wanda Film. At present, Beijing Wanda Investment’s foreign investment enterprises include Qingdao Wanda Cultural Investment Co., Ltd., Wanda Film joint stock company, and Beijing Wanda Film Distribution Co., Ltd.

Previously, Wanda Film transferred its equity twice in a row.

On the evening of July 11, Wanda Film announced that Beijing Wanda Investment intends to transfer its shares 180 million shares of the company to Lu Lili, the wife of the actual controller of Oriental Wealth, through the transfer agreement, accounting for 8.26% of the company’s total share capital, and the transfer price is 12.07 yuan/share.

On July 18, Wanda Film announced again that Beijing Wanda Investment and its concerted action Shanxian Rongzhi signed the "Share Transfer Agreement on Wanda Film joint stock company", Beijing Wanda Investment intends to transfer its holding of Wanda Film unlimited sale conditions 177 million shares (accounting for 8.14% of Wanda Film’s total share capital) to Shanxian Rongzhi, the transfer price is 13.17 yuan/share.

The above two Wanda Film equity transfers recovered a total of more than 4.50 billion yuan.

Wanda Film was founded in 2005 and belongs to Wanda Group. In the first half of this year, Wanda Film recorded revenue of 6.70 billion yuan to 6.90 billion yuan, an increase of 35.6% to 39.7% year-on-year; in terms of profit, the net profit attributable to shareholders of listed companies in the first half of the year was 380 million yuan to 420 million yuan, which was a turnaround from a loss of 581 million yuan in the same period last year.

Shanghai Ruyi, who entered the audience this time, is a dark horse in the domestic film and television industry in recent years. The company was established in 2013 and the actual controller is Ke Liming. In recent years, it has successively invested in films such as "Hello, Li Huanying", "Send You a Little Red Flower", "To Our Eventually Gone Youth", etc., and TV drama masterpieces include "No War in Beiping", "Langya List", "Biography of Miyue", etc.

This year, the box office hit "Vanishing Her" also participated in the investment. In addition, this year also led the investment of "Passionate" and "Keep You Safe". "Passionate", which will be officially released on July 28, is a film directed by Dapeng, starring Huang Bo and Wang Yibo, and starring Liu Mintao, Yue Yunpeng and Xiao Shenyang.

Ruyi Film and Television is a wholly-owned subsidiary of Hong Kong-listed China Ruyi. The second largest shareholder behind China Ruyi is Tencent.

On July 4, 2023, China Ruyi entered into a share purchase agreement with the subscriber to issue a total of 2.50 billion subscribed shares at HK $1.60 per share, raising a net amount of HK $4 billion, 90% of which is intended to be used for the development and expansion of the film and game business.

According to the announcement of the Hong Kong Stock Exchange, Tencent completed the subscription of Chinese Ruyi new shares through its subsidiary Water Lily on the same day, holding 2.546 billion shares, and the shareholding ratio increased to 25.45%, further solidifying the position of major shareholders.

Before that, the predecessor of China’s Ruyi was Hengteng Network. In October 2020, Hengteng Network suddenly announced that it would acquire Ruyi Film for HK $7.20 billion, and Ruyi Film was listed on the backdoor.

Hengteng Network is a joint venture between Evergrande and Tencent. Before the acquisition of Ruyi, Evergrande and Tencent held 55.6% and 19.32% of Hengteng Network respectively. Evergrande is the leading company and its main business is Internet streaming media platform.

According to Yicai, Wanda has frequently "raised funds", behind which its debt repayment pressure cannot be ignored. As of the end of June 2023, Wanda Commercial manages the stock of domestic open market bonds of 12.341 billion yuan, and the stock of overseas bonds is about 1.80 billion US dollars. Among them, Wanda Commercial manages a bond of 400 million US dollars with a maturity date of July 23.

In view of the debt repayment pressure of Wanda, the rating agencies such as Chengxin International, Fitch, Moody’s, and Standard & Poor’s have successively adjusted the rating/rating outlook of the joint stock company of Dalian Wanda Commercial Management Group.

S & P pointed out that after Wanda Commercial repaid the RMB 9.60 billion bonds due in April 2023, its combined cash balance fell from 30.50 billion yuan to 15 billion to 20 billion yuan by the end of Quarter 1 in 2023, so Wanda Commercial will face tremendous repayment pressure in the next 12 months. Of this combined amount, it is estimated that about 8 billion yuan to 10 billion yuan of cash is retained at the management level of Zhuhai Wanda.

Fitch said the downgrade was based on Dalian Wanda Commercial Management’s confirmation to Fitch that it had failed to pay the coupon on the $400 million bond due in 2025, which was due on July 20, 2023. Wanda said it expected to complete the coupon payment within a grace period. According to the bond prospectus, the issuer has a 10-day grace period before the default event is triggered.

Regarding the intensive adjustment of ratings, Wanda Commercial Management Group said that the company’s operations are stable and its profitability is good. The company will fulfill its information disclosure obligations in strict accordance with the provisions and requirements of relevant laws and regulations, and remind investors of relevant risks.