Analysis on the present situation and development of global biodiesel industry

In the EU, by 2030, the new consumption of biodiesel and fuel ethanol in the EU will only be over 1 million tons, and the UCO (waste oil) will increase by about 400,000 tons. The United States, 2023— In 2025, the use of biodiesel in the United States will increase steadily, and there will be some increase in the past two years. In Malaysia and Indonesia, only when B30 is implemented in the former and B40 is implemented in the latter, will biodiesel in the two countries increase significantly in the future.

[Definition of biodiesel]

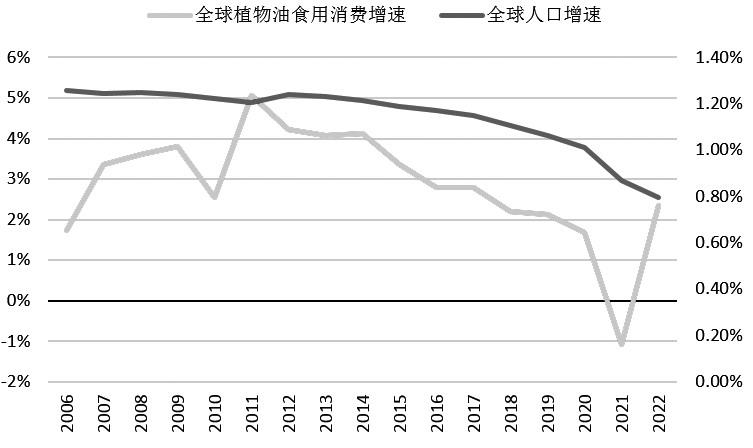

With the improvement of urbanization in developing countries and underdeveloped countries, the growth rate of global oil consumption gradually increased before 2011. However, due to the slowdown of population growth, the growth rate of global edible oil consumption gradually declined, and even fell to a negative value in 2021, and began to recover in 2022.

The picture shows the global vegetable oil consumption growth rate and the global population growth rate (unit:%).

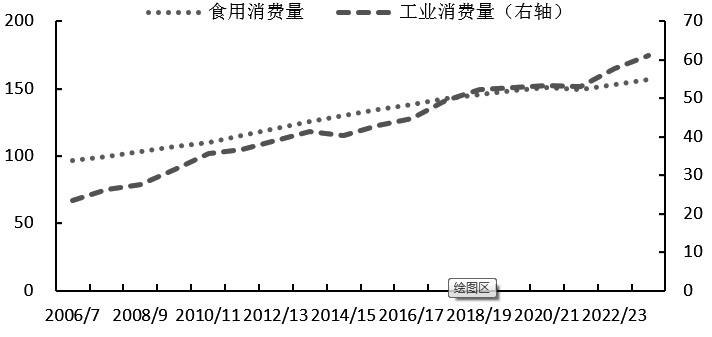

The picture shows the global edible consumption and industrial consumption of oil (unit: million tons).

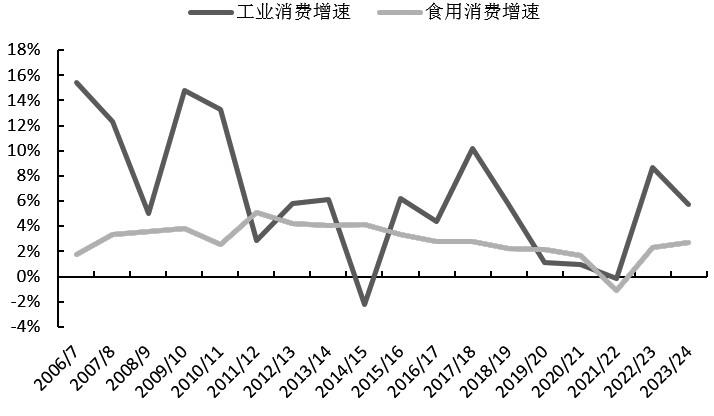

The picture shows the growth rate of global edible oil consumption and industrial consumption (unit:%).

With the slowdown of global population growth, the growth rate of vegetable oil demand has declined. The growth rate of industrial demand such as biodiesel is bright, but the current consumption is less than that of edible consumption.

In 1897, Rudolf Dissel, the inventor of diesel engine, tried to use vegetable oil as fuel in his engine. The fuel made of vegetable oil and animal fat, which we call biodiesel, is mainly used in diesel engines, and has similar characteristics to diesel fuel from petroleum fractions, including biodiesel, renewable diesel, renewable jet/aviation fuel and renewable heating oil.

Biodiesel (first-generation biodiesel) is usually called FAME biodiesel or FAME for short, and is produced by a process called transesterification (FAME stands for fatty acid methyl ester). Pure FAME biodiesel made by this process is called B100 in the industry.

It should be emphasized that the first generation of biodiesel is not a hydrocarbon fuel like petroleum diesel, so it is different from diesel in several key aspects. First, the first generation of biodiesel contains oxygen, which reduces the energy volume by about 7%; Secondly, higher oxygen content will limit its storage time, because oxidation will lead to corrosion; Thirdly, when the storage tank is poorly managed, the chemical composition of the first-generation biodiesel makes it more susceptible to microbial pollution, which may lead to corrosion of the storage tank and blockage of the fuel pipeline; Finally, the temperature of the first generation biodiesel is higher than that of diesel. If the temperature is too low, the fuel will eventually solidify completely. Therefore, the mixing ratio of the first generation biodiesel and diesel oil is limited.

Renewable diesel oil (second generation biodiesel), sometimes called hydrotreated vegetable oil (HVO) or green diesel oil, is produced by various production processes. The hydrotreating process is similar to the process used in crude oil refineries to "crack" crude oil into gasoline, diesel oil and other petroleum products. Therefore, the first generation of biodiesel production facilities are increasingly being partially or completely transformed by crude oil refineries.

The first-generation biodiesel is fundamentally different from the second-generation biodiesel because it only contains hydrogen and carbon, making it the same hydrocarbon fuel as petroleum diesel. Although different from diesel, renewable diesel is very close to diesel and is considered as a "direct" substitute for diesel. In other words, renewable diesel oil can be used as a modern diesel engine without mixing with diesel oil, which is also more environmentally friendly and has relatively loose use conditions. At present, the United States, the European Union, Indonesia, Malaysia and Brazil are the main producers and consumers of biodiesel in the world.

[Comparison of consumption in different regions]

United States of America

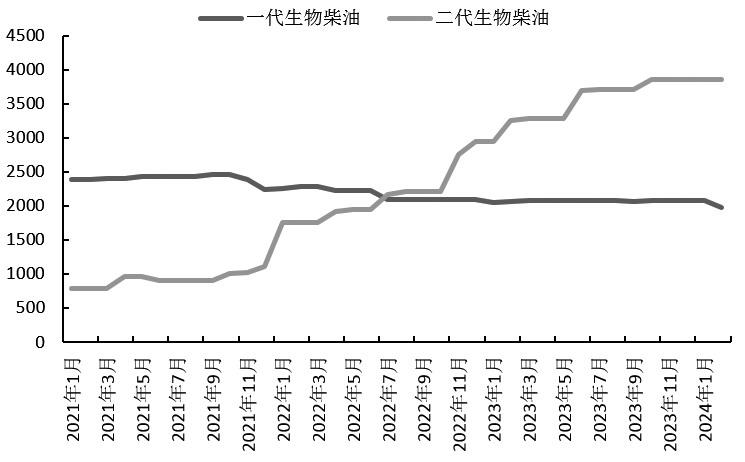

The picture shows the production capacity of first-generation biodiesel and second-generation biodiesel in the United States (unit: million gallons)

Since July 2022, the production capacity of the first generation of biodiesel in the United States has been gradually surpassed by the second generation of biodiesel, because the latter is cleaner and more environmentally friendly, and in addition, it has received more subsidies when blended with diesel in the United States. By February 2024, the production capacity of the second generation biodiesel reached 3.857 billion gallons, while the production capacity of the first generation biodiesel decreased to 1.984 billion gallons.

By August 2023, there were 59 biodiesel plants in the United States, with a production capacity of 136 million barrels per day, mainly distributed in major soybean producing areas and coastal areas. In 2023, the utilization rate of the first generation biodiesel in the United States reached 82.07%, higher than 78% in 2022. The capacity utilization rate of the second generation biodiesel is only 70%, but it is also higher than 51% in 2022. In January 2024, the first generation biodiesel production in the United States reached 127 million gallons, which was lower than 136 million gallons in the same period in 2023. With the decline of production capacity, the output also decreased. The net import was 1.056 million barrels, the highest level in the same period in history, and the imports mainly came from Asia and South America. In January, the consumption of first-generation biodiesel in the United States reached 156 million gallons, higher than 142 million gallons in the same period in 2023. The monthly consumption was high, but the growth rate declined. At the end of January, the first-generation biodiesel inventory rose to 4.21 million barrels seasonally, slightly lower than the 4.29 million barrels in the same period in 2023, and the inventory was near the historical average.

In January, 2024, the output of second-generation biodiesel in the United States reached 237 million gallons, a record high, which benefited from the rapid expansion of production capacity and the continuous production blending profit. In January, the United States imported 855,000 barrels of second-generation biodiesel, the import volume was high, and the import source was the same as that of first-generation biodiesel. In January, the consumption of renewable diesel in the United States reached 156 million gallons, and the growth rate also slowed down, which was less than the growth rate of production. At the end of January, the inventory rose to 6.38 million barrels, the highest level in history. Therefore, compared with the first generation of biodiesel, the second generation of biodiesel in the United States was somewhat surplus.

The picture shows the annual increase of soybean oil used in biodiesel (unit: million pounds).

The United States is the second soybean producer in the world, so soybean oil has become an important raw material for biodiesel. Before August 2023, soybean oil accounted for the most of the raw materials, but it was later surpassed by raw materials such as animal fat and waste oil, mainly because the price of the latter was lower. At present, one pound of animal fat is 1 cent higher than one pound of American soybean oil. In addition, since the United States allowed the import of Canadian vegetable oil for the second generation biodiesel at the end of 2022, the United States began to import a large amount of vegetable oil, which also had an impact on the use of soybean oil. In February 2024, the United States consumed 888 million pounds of soybean oil, which was lower than 910 million pounds in the same period in 2023.

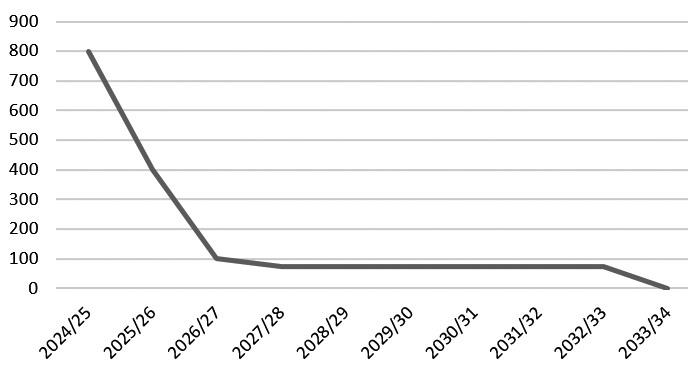

According to the estimation of USDA, the consumption of US soybean oil for biodiesel will increase by 800 million pounds in 2024/2025, and then decrease to 400 million pounds in 2025/2026, and will be less than 100 million pounds in 2027/2028.

EU

In 2018, the Renewable Energy Directive (Second Edition) (hereinafter referred to as REDⅡ II) was promulgated, requiring EU member states to achieve 32% renewable energy consumption and 14% renewable fuel in the transportation industry by 2030.

In 2021, the EU revised REDⅡ II. By 2030, the consumption of renewable energy in the EU will reach 40%, and the proportion of renewable fuels in the transportation industry will reach 26%.

On March 29th, 2023, EU institutions agreed to review RED(REDⅢ). On October 9, 2023, the Council adopted a new renewable energy directive (REDⅢ III).

The directive requires crop-based biofuels, such as biodiesel, ethanol and other renewable fuels, to maintain 7% in transportation, and the upper limit of the use of waste oil and animal fat remains unchanged. The main change is in advanced biofuels, that is, the target change of PART A in 2030, and it is specific to the sub-items.

It is estimated that the EU biodiesel production will reach 16.2 billion liters in 2023, an increase of 0.55% over 2022. The production capacity will reach 20.115 billion liters, and the capacity utilization rate will fall below 60% to 59.7%. There are 171 production enterprises in total, which is significantly lower than 212 in 2014. Among them, the output of second-generation biodiesel reached 4.2 billion liters, an increase of 0.6% over 2022. In 2023, imports increased by 11% to 3.6 billion liters. Consumption increased by 1.89% to 18.3 billion liters, and the ratio of storage to consumption decreased slightly to 3.99%.

In 2023, the EU consumed 15.08 million tons of biodiesel raw materials, an increase of 1.28% over 2022, which was the highest level in the same period in recent years. The EU is the region with the largest rapeseed production in the world. In 2023, the proportion of vegetable oil used in biodiesel rose to 42%, which is the largest oil used, reaching 6.375 million tons. Followed by waste oil, accounting for 29%, accounting for 4.35 million tons. Followed by palm oil, accounting for 9%, accounting for 1.4 million tons. In recent years, the proportion of vegetable oil use has increased slightly, the waste oil has increased steadily, palm oil has gradually decreased, and the rest oil has changed little.

At present, many countries have abandoned palm oil, and by 2023, the use of palm oil will further decrease by 15%. Since January 2020, France has excluded palm oil biofuels and become a pioneer in this movement. Austria also entered into force in July 2021. Although 2.65 million tons of palm oil reduced by 2030 can be replaced by UCO (waste oil) and bean oil (soybean is also a crop with relatively high ILUC risk, and the risk is only lower than palm oil), the proportion of fuel using UCO and other raw materials is limited to 1.7%, which is only 410,000 tons compared with 2023.

In 2030, the consumption of traditional biofuels based on oil and fat grains will be limited to 7%, that is, 19.6 million tons. Of course, it is not all biodiesel based on oil and fat, but also bioethanol. In 2030, the consumption of biodiesel (including hydrogenated biodiesel) with oil, UCO and animal oil as raw materials is expected to be only 18.3 million tons, with an increase of only over 1 million tons.

Therefore, in 2030, the EU biodiesel policy will have a relatively small increase in demand for oils and fats. According to the usage ratio and future targets, the consumption of renewable energy will still increase by more than 80 million tons. At present, the increase brought by the new policy is mainly advanced biofuel Part A..

Indonesia and Malaysia

Since the beginning of 2023, Indonesia has fully implemented the B35 biodiesel policy (diesel blended with 35% of the first-generation biodiesel). Due to the insufficient production capacity of the second-generation biodiesel, it has not continued to implement the target to B40(35% of the first-generation biodiesel and 5% of the second-generation biodiesel blended with diesel). In addition to successfully completing the road test in the transportation field, the government has also conducted tests in other fields. In 2023, Indonesia produced 13.15 million kiloliters of biodiesel and consumed 10.56 million tons of palm oil. The production target of 13.5 million kiloliters is set in 2024, but the new consumption of palm oil is only about 200,000 tons. Before the second generation biodiesel production capacity comes up, the growth rate of raw material consumption remains slow.

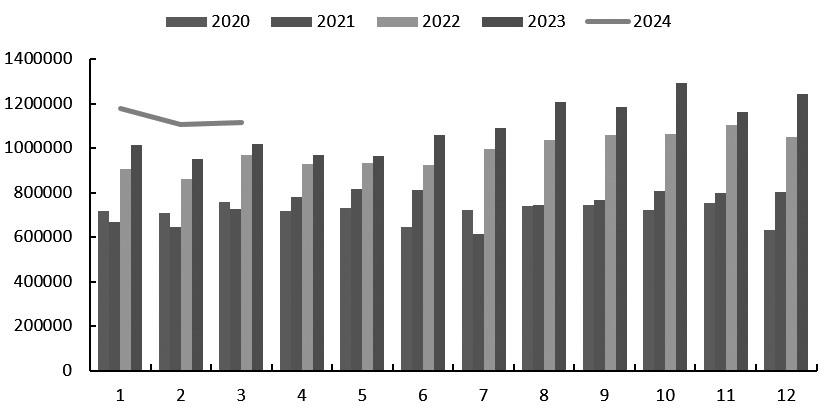

The picture shows the monthly output of biodiesel in Indonesia (unit: kiloliters).

In March, 2024, Indonesia produced 1.11 million kiloliters of biodiesel, which was the highest level in the same period in history. In March, the cumulative production was 3.4 million kiloliters, an increase of 14% over the same period in 2023. In March, the consumption of biodiesel was 1.01 million kiloliters, maintaining a high level, 1-mdash; In March, the cumulative consumption was 3.17 million kiloliters, an increase of 14% over the same period in 2023. However, exports are at a low level, with only 4,597 kiloliters exported in March, which is lower than 22,988 kiloliters in the same period in 2023, 1-mdash; In March, the cumulative export decreased by 90 kiloliters.

The Malaysian government intends to launch the B20 policy before 2023, but it has not yet been realized. It may skip B20 and look forward to the B30 mission in 2025, which is in line with Malaysia’s commitment to the Paris Agreement in the United Nations Climate Change Conference. In order to support the task of biodiesel, the government maintains an effective financial support mechanism implemented since 2006. This fund is calculated by Malaysian Palm Oil Bureau (MPOB) according to the tariff levied on palm oil, and it is expected to be 9.7 million US dollars in 2023, which is far less than the Indonesian government’s subsidy for biodiesel production.

At the 21st United Nations Climate Change Conference held in Paris, Malaysia promised to reduce greenhouse gas emission intensity as a proportion of GDP by 45% by 2030. At present, only Sarawak, Labuan and Langkawi have carried out the B20 mission. In 2023, Malaysia’s biodiesel production was 1.078 billion liters, slightly lower than 1.151 billion liters in 2022, but the consumption in 2023 increased by 60 million liters to 1.015 billion liters compared with 2022, and the export performance was also average, which decreased to 233 million liters in 2023. In 2023, the production of biodiesel consumed 991,000 tons of palm oil, which was lower than 1.059 million tons in 2022. Since 2018, the consumption of palm oil has not increased greatly, and it has remained around 1 million tons. If B30 policy is implemented in 2025, the annual palm oil consumption will increase by more than 500,000 tons.

Brazil

Brazilian Federal LawNo. 11097/2005 stipulates and establishes the legal authorization for the use of biodiesel as fuel, but there is no mandatory requirement. It was not until 2008 that biodiesel (B2) was compulsory in China, that is, all diesel must be blended with 2% biodiesel (B2).

On March 17, 2023, Brazil increased the current biodiesel rate from 10% to 12%, effective from April 1. This decision was made by Brazil’s National Energy Policy Committee (CNPE). In December 2023, CNPE decided to raise the requirement of biofuels to 14% in March 2024 and 15% in 2025.

Since Brazil’s biodiesel production target was raised, the monthly biodiesel production has gradually increased. In March 2024, it produced 740,000 cubic meters, which is at a historical high level, 1-mdash; In March, the cumulative production was 1.46 million tons, an increase of 36% over the same period in 2023.

Brazil is the world’s largest soybean producer and exporter, with abundant soybean raw materials, but in recent years, the proportion of Brazilian soybean oil in raw materials is 66%, which is lower than before. In 2023, the consumption of soybean oil was 4.61 million tons, and it is expected to reach 5.5 million tons in 2024, corresponding to the need to squeeze 4.81 million tons of soybeans. If the blending rate of B15 is smoothly and continuously implemented in 2025, 6.11 million tons of soybean oil will be consumed in 2025, and 3.2 million tons more soybeans will be squeezed than in 2024.

[Forecast of output and raw material changes]

In 2023, the total output of biodiesel in the United States, the European Union, Indonesia, Malaysia and Brazil reached 5.4 billion liters, and the United States surpassed the European Union to become the country with the largest biodiesel output. In recent years, the output growth rate of the United States is the fastest, followed by Brazil, Indonesia and the European Union, while Malaysia even dropped slightly.

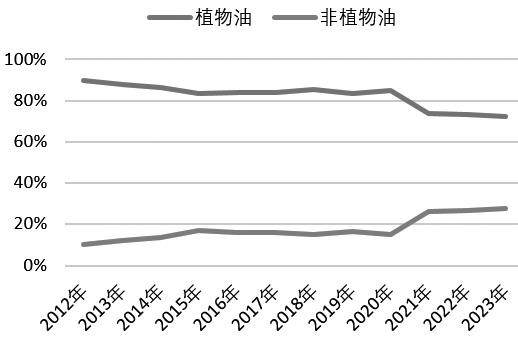

The figure shows the proportion of vegetable oil and non-vegetable oil raw materials (unit:%)

Due to the preferential policies of governments on renewable fuels (such as waste oils and cellulose fuels), the consumption growth rate of vegetable oil raw materials has slowed down, and the proportion of vegetable oil raw materials in the total raw materials has decreased in recent years, while other non-vegetable oil raw materials have increased, so it also shows that the consumption growth rate of vegetable oil raw materials is lower than that of biodiesel production.

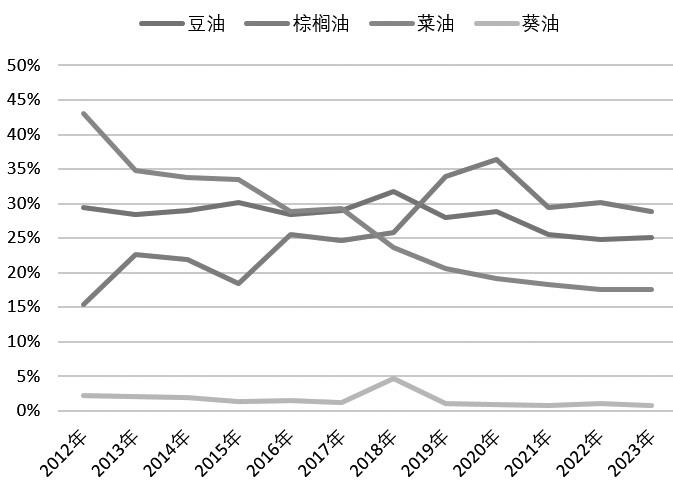

The picture shows the proportion of soybean oil, vegetable oil, palm oil and sunflower oil (unit:%)

In 2023, biodiesel production in the above five countries consumed 32.39 million tons of vegetable oil, higher than 28.29 million tons in 2022, of which palm oil consumption accounted for 29% of all raw materials, and its share declined year by year from the highest 36%. Soybean oil accounts for 25%, vegetable oil accounts for 18%, sunflower oil only accounts for 1%, and the proportion of palm oil, soybean oil and vegetable oil is declining year by year, mainly due to competition from non-vegetable oil raw materials.

For the sake of environmental protection, by 2030, the new consumption of crop-based biofuels in the EU, including biodiesel and fuel ethanol, will only be over 1 million tons, and the UCO will increase by about 400,000 tons, and the rest will mainly be cellulose, municipal waste and algae. According to the renewable fuel standard of EPA, 2023— In 2025, the usage of biodiesel in the United States will increase steadily, with 2.82 billion gallons in 2023, 3.04 billion gallons in 2024 and 3.35 billion gallons in 2025. However, the proportion of soybean oil is also squeezed by raw materials such as animal fat and waste oil, and there will be some increase in the past two years, but the long-term increase will decrease. Malaysia and Indonesia, as the main palm oil producers, will have a significant increase in biodiesel in the future only when the former implements B30(2025) and the latter implements B40, but at present, the increase in biodiesel in the two countries is still very small. If Brazil’s biodiesel directive is successfully implemented, Brazil’s biodiesel production and soybean oil consumption will be higher by 2025 and before, but there will be no increase from 2026, which requires further government support, especially for the second-generation biodiesel with relatively insufficient production capacity. (Author: Zijin Tianfeng Futures)