Many brands suddenly cut prices sharply! Netizen: Will it drop again?

Wen | Zhazha

We won’t fall in love, which is partly due to Rene Liu and Rene Liu’s songs.

Most love is not equal, so you have to accept the fact that it is hard to say with one hand.

Want to ask if you dare? /Crazy for love like me (Crazy for Love)

Love requires great efforts, and often there is no return.

I’ll forget you when I wait for you for half a year ("I’ll wait for you")

Love should be compromised.

I love you very much/only when I let you have love/can I feel at ease ("Love you very much")

Have to wait.

Love is a superstition in the right place at the right time/Oh, so you are here ("So you are here")

It is possible that no matter how hard you struggle, you will still be single.

The person you like doesn’t show up/the person who does doesn’t like it/some people hesitate/leave while thinking about him ("Loneliness for a lifetime")

Even if you are in love, you will still be lonely.

There is no conflict between my strength and your tenderness/I am happy with you/just as I am satisfied with having you ("I dare to be alone in your arms")

If something goes wrong, you should let the other person go first and leave the sadness to yourself.

The escape for you is infinitely wide/until you are flustered and let you go/in exchange for my sorrow, happiness and tenderness ("April Day")

Even if you break up, you should think more about others.

In fact, I am also grateful/when I heard that you/still believe in love ("Heard")

This is the concept of love presented in Rene Liu’s music, which is bitter and miserable, but it is necessary to squeeze out a smile without complaint.

We grew up listening to Rene Liu’s songs, demanding love, waiting for love and worshiping love, but it seems that we are far away from love forever.

Then Rene Liu made a movie, "Later Us", the title of which had already finished the story, everything happened, and later; About you and me, we. It is the eternal theme in Rene Liu’s songs and the first sentence of Later:

Later/I finally learned how to love/but you have long since gone/disappeared into the sea of people.

This is a very simple love story. Looking around, everyone’s experience is hidden in this story.

Two young people who worked hard in Beijing met on the train when they came home for the New Year. It was in 2007, when two people in Beijing did not meet, and the train that stopped temporarily made them friends.

Seeing that the boy has just graduated, he said that his dream can only be realized in Beijing.

Xiao Xiao, a girl, has lived alone for many years. I heard that she can stand on her feet after five years of hard work in Beijing, and she is still one year away.

The common enemy makes them close friends, and this enemy is called hometown.

Now train tickets are purchased online and in real name, which is the largest short-term migration of human beings — — Spring Festival travel rush, not so crowded, bullets.

Ten years ago, Spring Festival travel rush needed to be squeezed out abruptly. A bowl of instant noodles had to be handed to people hand in hand in a crowded carriage. When it really reached the soup, it was cold and the noodles were lump.

Ask people why they want to go home, rather than why they want to leave home.

Girls should be stable, a house in Beijing; Boys have ideals and finish their own works. The self-esteem and arrogance of youth can only be supported by Beijing.

Beijing is so big that the distance from the North Fifth Ring Road to the South Fifth Ring Road is six times the height of the troposphere.

What hasn’t changed is that they met again.

This Spring Festival, they returned to Beijing for the New Year from a different place. Yes, Beijing has finally become their home. It’s just that the members of this family don’t have each other

They talked a lot that night, from the winter 10 years ago to today.

Ten years, what happened to them?

The ten years of love, dullness, entanglement and reunion between the two vividly answered "How will Rene Liu’s syndrome fall in love?" This eternal problem.

They have known each other for ten years, and she remembers the funny way he undressed for the first time. The joy that a broken sofa brings to life when you are in a humble room; The first kiss; The smell of his father’s cooking; He doesn’t talk for two or three days when he is angry … …

They love each other and cherish each other, and the audience knows that they didn’t end up together. This story is told generously. This is "later us".

But no one knows what beats love.

"Later We" digs out every little thing in love, every joy, every quarrel, and every appearance is inseparable.

Ah, it turns out that those seemingly "nothing" trivial things corrode love a little and eventually collapse. They are: money, reality and desire. They are shown in the smallest details of life, which are too ordinary compared with the occurrence of a relationship, but they have the support of the whole world.

Love is a subtle existence close to the ideal in real life. To choose love is to choose to fight against cruel reality to some extent.

"Later Us" seems to be a gentle and tearful love movie, but in fact it is a bloody "war movie", and what died was the imagination of the ideal life and the naive and arrogant self.

The story of Later Us comes from the first novel "Chinese New Year, Go Home" in Rene Liu’s collection of essays "My Imperfection".

The novel tells a special heterosexual relationship through several letters from a pair of former lovers. They loved each other, and they still love each other, but they are not husband and wife, relatives or even friends, but their names exist in their own lives, unique and cautious, like an alias of their youth.

"Thank you in the past days, whether we were together or not," Shu Fang wrote in her letter to Ah Zhi in the novel.

This is what Rene Liu, a young woman in literature and art, did: acting in movies, singing, writing, and now making movies to explain the possibility and applicability of "love". A love life can witness a person’s growth, change, aging, or death.

Li Pingbin, a gold photographer who won the Golden Horse Award for seven times, brought two different colors of black and white to the film ten years ago, and color narration became one of the highlights of the film. Jianqi Chen, a famous Taiwan Province pop music producer, composed the music; Get out of here! Yuan Yuan, the screenwriter of tumor jun, became one of the screenwriters.

Director Tian Zhuangzhuang, who surprised everyone with his acting skills in "Love each other", played Jing Bo Ran’s father and continued to make people cry with his little humor and steady voice.

The two leading actors, Jing Bo Ran and Zhou Dongyu, have become the benchmark among young actors in the Mainland.

Also in April last year, Zhou Dongyu enjoyed all the aura of love comedy in the chick movie Like You, and was captured to Takeshi Kaneshiro with a good dish. Even this role made her beat Zhang Aijia in Love, Zhou Xun in When is the Moon, and Wen Qi in Carnival to win the actress of the year award of the 9th China Film Directors Association.

Fang Xiaoxiao, played by Zhou Dongyu in "Later Us", is easily reminiscent of "July and An Sheng". She is still stubborn, free and easy, and full of vitality, and the mature charm of the film ten years later is a rare aspect of Zhou Dongyu.

Before "Later" came, Xiao Xiao, played by Zhou Dongyu, accepted Jing Bo Ran’s love. She is such a "realistic" girl, and her requirements are direct and accurate, which is a house, but Jing Bo Ran’s careless line in it touched me the most. He said:

"I want to buy eight houses in Beijing and give you one."

The feeling of commitment to reality is not love. Love is arrogance, fearlessness and nonsense. He not only wants to give everything he has, but also wants to give his dreams. There is no money for a taxi, and the ambition of "eight houses" is the most precious thing in him.

It is love that gives people the reason and courage to dream. Even if everything will become "later" in the end, love has brought us so close to "eight houses".

We Later is a new answer given by Rene Liu. All love, good and bad, right and wrong, and everything about love has changed, shaped and become us.

No matter how cruel the reality is, it is love, going home and dreams … … These beautiful memories, as well as the essence of "later", are always forgotten:

There is a boy/girl in love.

On the 25th of this month, Tik Tok, Didi, and Zhenledao jointly created a boutique miniseries "Dream on! Jingjing officially ushered in the end. As the first boutique miniseries produced by Tik Tok, Dream on! Jingjing was immediately sought after by users all over the network after it was launched. After only 48 hours of broadcasting, the number of related topics was over 100 million. By the end of the series, the number of main topics was 720 million, the number of feature films was over 110 million, and the total number of official shakes was over 290 million, making it the first phenomenon-level miniseries this year.

With the rise of online content and the popularity of users’ fragmented drama-chasing mode, since last year, various platforms have laid out mini-short drama tracks, and Tik Tok even called mini-short drama "tomorrow’s drama series". This time, with the help of "Dream! Jingjing’s entry into the mini-short drama market is not only a reflection of Tik Tok’s initiative to adapt to the needs of Internet users as a short video platform, but also an inevitable requirement for Tik Tok to move closer to upstream production from the middle and lower reaches after establishing a perfect entertainment marketing ecology. With "Dream on! Jingjing, Tik Tok will also launch 30+ S-class boutique miniseries this year to promote the development of the entire miniseries market with high-quality content.

"Dream on! Jingjing ended in high heat.

In the picture, Jingjing, who was dumped by her ex-boyfriend, is moping alone. At this time, the voice of live delivery in Li Jiaqi came from the mobile phone: this blind box of love can make lovelorn girls get an unprecedented love experience … This is Tik Tok’s online miniseries "Dream on! The first episode of Jingjing begins. As the first all-star love hilarious cross-screen miniseries in China, "Dream on! The popularity of Jingjing has soared since its launch, among which 20 male actors of # Jin Jing’s new drama once rose to the first place in the hot search list of Weibo. In Tik Tok Station, 19 topics accumulated on the hot list during the broadcast of the series, with a total of 24 days on the list. Among them, the challenge of boyfriend’s cross-dressing in # Gufeng Blind Box was linked with Chu Qi and many other top experts, and the number of topics played was as high as 2500w W.

In Dream on! After the close of Jingjing, fans from Tik Tok, Weibo, Douban and other platforms can’t wait to start looking forward to the second season. Some fans petition that the original cast can continue to play next season, and some viewers express the hope that the official can launch the same "blind box". In the comments on the closing episode of the twentieth episode, a Tik Tok user said that he happened to be in a lovelorn period just like Jingjing, the protagonist, while dreaming! Jingjing is short in length, but each episode can bring happiness to people. On Douban, after watching the question mark boyfriend played by Yu Jingtian in the last episode, some viewers admitted that "it’s so good to cry": my boyfriend may not be the most perfect, but a plain life can be very romantic.

As the first work of Tik Tok’s mini-drama market, Dream on! There are three important reasons why Jingjing can frequently go out of the circle and gain a double harvest of clicks and word of mouth after it is launched. First of all, it originated from the innovative story of the play, "Dream on! Jingjing revolves around Jingjing, a senior girl. Jingjing, who is in the mood for love, fell into the trough of her life because of lovelorn love. At this time, a "love blind box" with magical functions appeared. Through this product, Jingjing can experience the wonderful experience of falling in love with 20 different types of virtual blind box boyfriends in her dreams.

"Dream on! The plot of Jingjing seems to be unconstrained, but in fact it brings enlightenment to the current urban men and women with humorous style. For example, in the second episode, Jiro Wang, a popular actor, appeared as an "uncle boyfriend", and the handsome appearance of sunshine made Jingjing a "girl fan". However, just when the audience thought that the plot would continue to develop in the direction of "overbearing president fell in love with me", the screenwriter gave everyone a blow. The object of Jingjing’s dream of "uncle love" was actually a greasy and bald middle-aged man, which told the audience that the ideal was full and the reality was very skinny. For example, when she was in love with Hao Fushen, her boyfriend, Jingjing understood that the "little suckling dog" boyfriend she had missed so much actually had a naive side … It was by showing Jingjing’s love experience with different types of boyfriends, "Dream on! Jingjing explains the difference between reality and ideal to the audience, and also discusses various possibilities in urban love, thus gaining the emotional resonance of users and spontaneously joining the drama-chasing camp.

Secondly, Dream on! The reason why Jingjing can continue to be popular is also inseparable from the top production team and luxury card company of the series. This drama is the first self-made mini-short drama in Tik Tok, which is combined with Didi, Zhenledao and other head companies to integrate resources, aiming at creating the first S+ level boutique short drama in the whole network. At the same time, Dream on! Jingjing also invited Liu Ruifang, a 10 billion box-office producer who once created the series "People on a Embarrassed Road" and Dying to Survive, as the chief producer, and the joining of a popular actor such as Jin Jing, Michael Chen, Leon and Jiro Wang made this miniseries even more icing on the cake. Actors also show off their charms in the drama, such as Jiro Wang, who first appeared in the style of long trousers and baldness, Dylan, who showed the style of women’s clothing, and Henry, who appeared in a red Chinese-style chest covering, etc., all of which contributed a lot to the drama and became a hot topic of drama powder. In addition, in the casting, "Dream on! Jingjing also boldly launched KWIN, Yu Jingtian, Saixixi and other newcomers, and their subsequent performances in Youth with You 3 made the audience see more possibilities from them.

Finally, Dream on! The continuous fermentation of Jingjing’s popularity is also closely related to the innovative marketing game introduced by Tik Tok. The play started with the topic of "blind box", which is popular among young people at present, and successfully attracted the attention of the audience. In Dream on! During the launch of Jingjing, Tik Tok also pushed out the popular boyfriend heartbeat list in the station, calling on users to call for their idols, thus unlocking more exclusive tidbits. By the end of the campaign, more than 400w fans had voted, and KWIN ranked first in the heartbeat list with 814,200 votes. In this way, Tik Tok has fully aroused the enthusiasm of users for pursuing dramas. With the spontaneous participation of a large number of users, it has boosted the second fermentation of the reputation of dramas, thus attracting more "tap water" to join the drama-pursuing camp and continuously increasing the exposure for the dramas.

Why does Tik Tok enter the miniseries market?

After years of deep cultivation in the field of film and television publicity, Tik Tok entered the miniseries market for the first time as a newcomer, and launched the first boutique miniseries "Dream on! Jingjing has made a series of remarkable achievements, and Tik Tok chose to enter the miniseries market at this time, which, in my opinion, has four advantages.

First of all, it comes from users’ demand. According to the Research Report on the Development of Network Audiovisual in China in 2020, the number of short video users in China has reached 818 million, accounting for an increasing proportion. According to the White Paper on Entertainment in Tik Tok in 2020, users’ demand for quality content is increasing, and women account for 59% of the users who pursue dramas in Tik Tok, making them the main audience in the drama market in Tik Tok. On this basis, it is just the right time for Tik Tok to enter the miniseries. According to the list of the first batch of Tik Tok miniseries released by Tik Tok in 2021, it can be seen that these works mainly focus on love, sweet pets and other themes, which can accurately locate the users in the circle and also play an important role in laying the foundation for Tik Tok’s layout in the miniseries market.

Secondly, Tik Tok’s choice to enter the miniseries market actually coincides with the current development trend of content. Since 2012, various platforms have launched a series of short drama prototypes, such as "diors man" and "Best Lady", which have given birth to rich soil for the development of short dramas; With the popularity of short video platforms in recent years, users’ demand for high-quality mini-short plays is also increasing. At this time, entering the mini-short play market can be said to be the embodiment of Tik Tok’s compliance with the development trend of content. As the head short video platform in the industry, Tik Tok’s participation will also effectively boost the development of high-quality mini-short plays.

In addition, this year, the competent authorities further clarified the production standard of "network miniseries", which means that the brutal growth of miniseries in the past is expected to change. On this basis, Tik Tok also actively responded to the management requirements of the competent authorities. After officially entering the boutique miniseries track this year, Tik Tok formulated and published a unified standard for miniseries that meets the requirements of the Tik Tok platform, including four indicators: single episode of 1-5 minutes, more than 12 episodes, vertical screen and comprehensive duration of more than 24 minutes. With the first miniseries "Dream on! With the launch and popularity of Jingjing, Tik Tok is also expected to assume the role of the founder, and promote the development of the mini-short drama market towards maturity and standardization.

Tik Tok platform has a natural advantage in entering the mini-short drama market. On the one hand, Tik Tok has a huge user group. At present, DAU in Tik Tok has exceeded 600 million. For a long time, the platform has accumulated a large number of drama-chasing groups, cultivated users’ drama-chasing habits, and has already possessed the soil for incubating miniseries; On the other hand, Tik Tok has been deeply involved in the field of film and television publicity for many years, and he can accurately grasp the user’s interest points. However, the miniseries are concise in plot and compact in rhythm, which is highly consistent with the consumer psychology of Tik Tok users. According to the "2020 Tik Tok Entertainment White Paper", the amount of story content submitted by Tik Tok Platform is as high as 5.9 billion, and the penetration rate of consumer users is 93%. Driven by the dual needs of users and the development of the industry, the development of boutique micro-short drama business in Tik Tok can be described as a natural thing.

30+S-level boutique miniseries throughout the year

What signals did Tik Tok release to the industry?

Dream on! Jingjing, Tik Tok has laid a solid foundation for entering the micro-short drama market. In this year, Tik Tok is expected to produce 30+ S-class quality mini-short plays. In its first batch of films, in addition to Dream! In addition to Jingjing, it also includes Don’t be afraid, fall in love! "Nanxiang Technical School", "The Moment of Stars" and "Why do you want to celebrate the New Year? ! There are 5 mini-short plays, etc., which meet the viewing needs of different audiences with various types of works. As a newcomer to the miniseries market, what kind of business logic is behind the layout of miniseries market in Tik Tok, and what signals are released, which are all the concerns of the whole industry.

After years of deep cultivation in the field of entertainment content, Tik Tok has accumulated rich experience. From the initial announcement and production of comprehensive film and television content to the self-made miniseries, after establishing a perfect entertainment marketing ecology, it is the general trend to move closer from the middle and lower reaches to the upstream production end, and entering the miniseries market can also promote the diversification of Tik Tok’s entertainment ecology. Dream on! Tik Tok will gradually become a co-creator of entertainment content, starting with fine miniseries such as Jingjing.

With the launch of more fine miniseries, Tik Tok will also promote the coordinated development of the whole industrial chain and achieve a win-win situation. According to the White Paper on Entertainment in Tik Tok in 2020, in the 30+ S-level boutique miniseries planned to be launched in 2021, Tik Tok will carry out in-depth cooperation with head film and television production companies such as Zhenledao, Huayi Chuangxing, Tangren Film and Television, and head brokerage companies such as Wow Wow, Lehua, and cooperate with IP parties such as tomato novels to push miniseries into a batch and systematic development mode. This signal released by Tik Tok means that the platform has been laid out in advance in terms of IP supply, content quality and star lineup, and by integrating the advantages of the platform and multi-party resources, copyright owners, content producers and platforms can achieve multi-win results.

In addition, in the era when content is king, fine miniseries are becoming the core driving force of Tik Tok’s content consumption. With the launch of more fine miniseries in the future, it can also feed back the development of the platform-on the one hand, it attracts more users with good content internally, improves the user retention rate and effectively helps the growth of platform users; On the other hand, fine miniseries are easier to get out of the circle, which in turn can increase the volume of the platform and enhance the brand image of Tik Tok.

With the launch of the next 30 +S quality mini-short plays, I believe Tik Tok will soon become an innovator and leader in the market, and be promoted from a newcomer to the "number one player" in the mini-short play market.

— THE

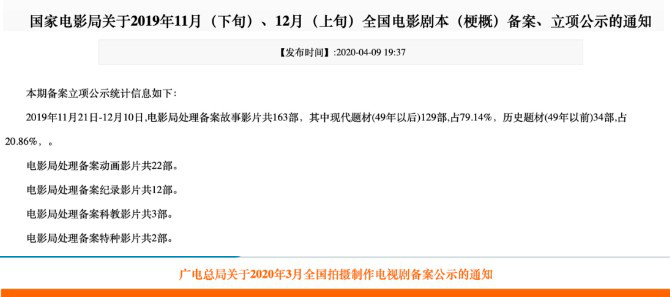

1905 movie network news The State Film Administration and the State Administration of Radio, Film and Television released the latest project news! This means that there is another big wave of new movies and new dramas coming!

In terms of movies, there are many popular dramas with the same name, Mahua FunAge’s new works and so on.

In terms of TV series, the movie starring Zhou Dongyu Takeshi Kaneshiro will be turned into a drama, and Anne Baby’s "Farewell to Vian" remake is also on the list. In addition, we also like to mention Zhu Yilong’s new drama. ……

Not much to say, let’s take a look!

Movie: The movie version of Hua Qiangu has finally arrived.

Yinan Diao cooperates with Zhou Dongyu and Haoran Liu.

Hua Qiangu.

The picture shows the poster of the TV series Hua Qiangu.

The film version of Hua Qiangu has passed the project, and the project company is the company of Tang Lijun, one of the producers of the drama version of Hua Qiangu — — New faction culture media co., ltd.

In 2017, the online version of Hua Qiangu will be filmed. At that time, it was reported that it was difficult for the leading role in the drama version to get together, and the leading role in the film version was intended to choose from Guan Xiaotong, Dilraba and Angelababy. In addition, Mark Chao, Li Xian and Neo were also alternate actors in the film version of Hua Qiangu at that time.Once, some media called the copyright owners of Hua Qiangu TV series and movies, and the response was that the actors were uncertain.

Now that the film version is allowed to start shooting, who do you most expect to play?

Moses on the Plain

Adapted from Shuang Xuetao’s original book of the same name, the film will be produced by Yinan Diao, directed by Zhang Ji and starring Zhou Dongyu and Haoran Liu.

As we all know, Yinan Diao is internationally renowned for winning the Gold and Silver Bears. Zhou Dongyu and Haoran Liu are also young actors who are recognized for their acting skills. The original book Moses on the Plain was scored 8.3 in Douban.

It’s hard not to expect such a cast and script!

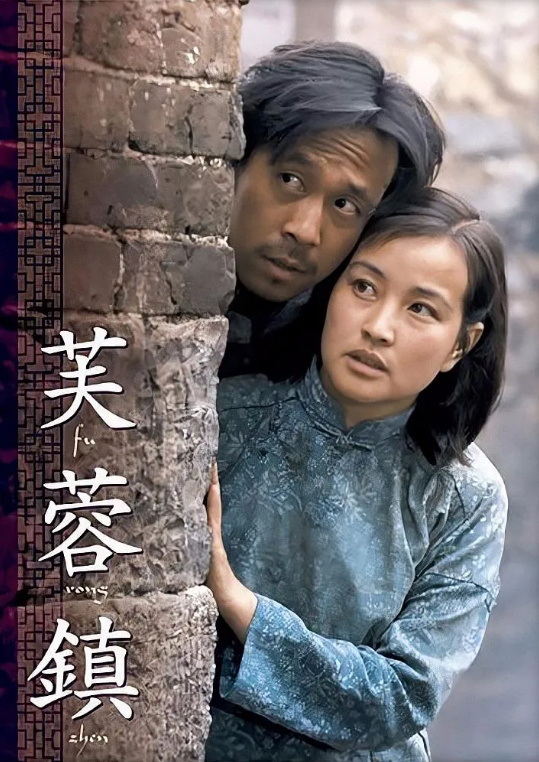

New furong town

The picture shows the old poster.

The film "New furong town" written by Li Tao and Bu Yangui was approved for shooting!

In 1986, furong town, directed by Xie Jin and starring Jiang Wen and Liu Xiaoqing, won two best film trophies. Since then, this ancient town has become famous all over the country. In the blink of an eye, more than 30 years have passed, and many changes have taken place in furong town.

The story of New furong town is also closely related to the changes in furong town.

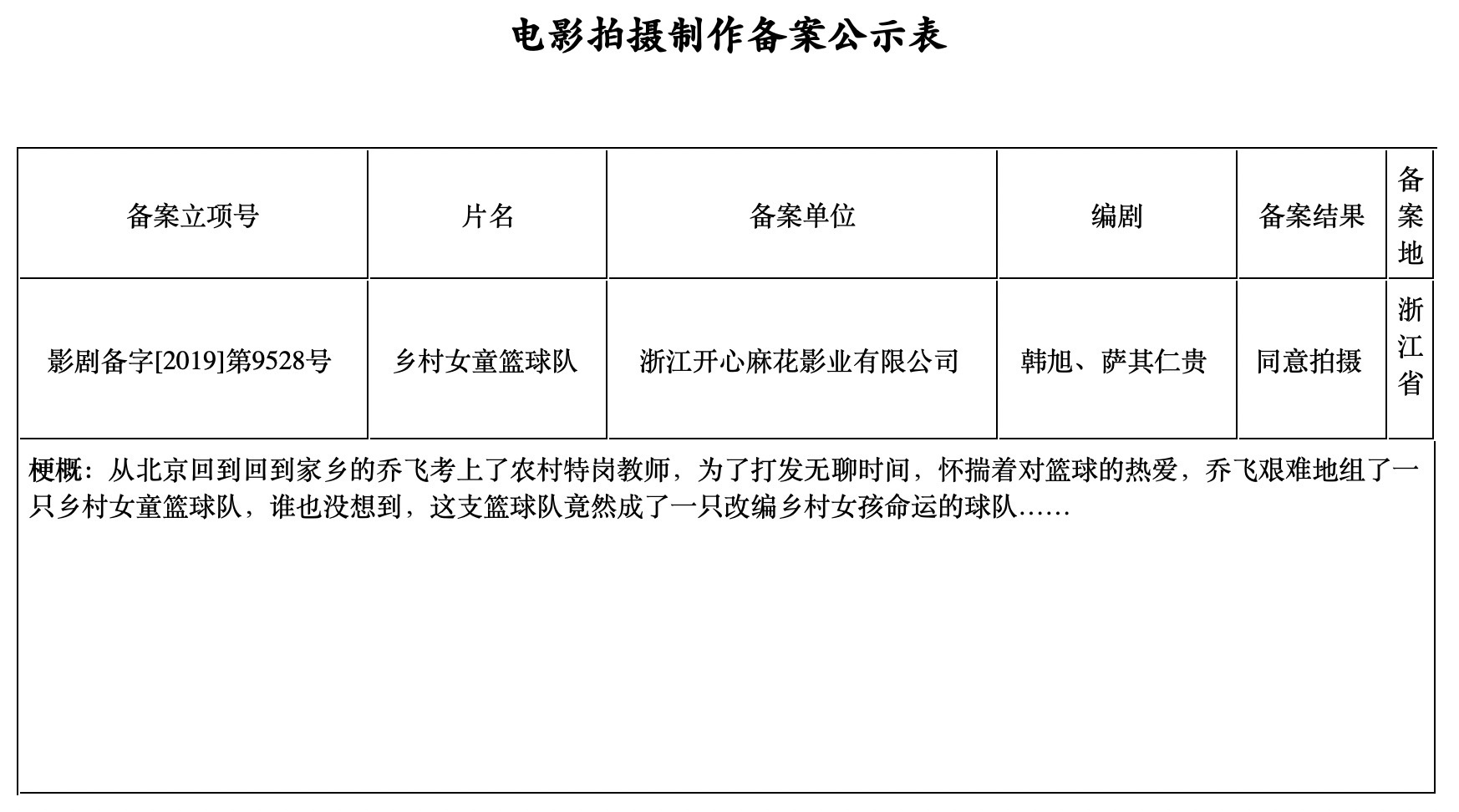

There’s a new film in Mahua FunAge!

Mahua FunAge’s new film "Country Girl Basketball Team", written by Han Xu and Saqirengui, was officially launched. It is reported that the film takes basketball as the breakthrough point and focuses on a rural teacher and a basketball team composed of rural girls.

From the point of view, this will be another work with tears in laughter.

Ice hockey dream path

The picture shows the European poster.

In 2018, Yue Long China-Europe Cooperation Project Laboratory collected outstanding film ideas around the world, and the 3D animated film idea "Ice Hockey Dream Path" selected by Ourui Animation was successfully selected.

"Ice Hockey Dream Path" tells a story about a dream, and choosing the project at this time also means a gift to the 2022 Winter Olympics.

Tv series: the main melody works have been re-established

A large number of excellent novel writers have emerged.

Meritorious deeds

The picture shows Zheng Xiaolong.

Merit is a TV series directed by Zheng Xiaolong, Shen Yan, Lin Nan, Yang Wenjun, Mao Weining, Kang Honglei, Yan Jiangang and Yang Yang.

The play is divided into eight units: Yu Min, Shen Jilan, Sun Jiadong, Li Yannian, Zhang Fuqing, Yuan Longping, Huang Xuhua and Tu Youyou, and tells the stories of eight meritorious figures.

"We don’t pursue writing a long biography of each meritorious person, but intercepting the most colorful part of their lives, so as to achieve outstanding themes, exquisite structures, distinctive characters and compact plots. We not only pursue different styles of grouped stories, but also realize the unity and integration of the whole, so that the broad audience can understand, see and like to watch." Zheng Xiaolong said.

This kind of creation form is similar to that of, I wish it has the same praise!

Farewell to Vivian

Anne Baby’s original book Farewell to Wei ‘an includes short stories such as Farewell to Wei ‘an, July and Peace, Warm Warmth and Seven Years.

Previously, the film version of July and An Sheng starring Zhou Dongyu and Sandra won a double harvest at the box office. Later, Iqiyi took the lead in remaking the TV series of the same name, starring Shen Yue and Chen Douling.

This time, I wonder if you are also looking forward to the story of Farewell to Vian, and who do you want to play?

Finally waiting for you

The picture shows the movie version of "Like You" poster.

The movie "Like You" starring Takeshi Kaneshiro and Zhou Dongyu will be remake! The original play of the same name — — Finally waiting for you.

The story tells the story of Gu Shengnan, a little cook, and Lu Jin, her boss, who went from tell it to the judge to "meeting friends by eating" and struck a spark of love in their coexistence.

In the movie version, although there is a big age difference between Zhou Dongyu and Takeshi Kaneshiro, they have a strong sense of cp. It is reported that the male and female hosts of the drama version are LinYu Shen and Zhao Lusi.

Lin Yushen plays Yang Xiao in the new edition of "Eternal Dragon Slayer", in which his love with Ji Xiaofu is deeply regrettable.

In recent years, Zhao Lusi has also appeared in Meng Wife Gourmet, Phoenix Prison Phoenix, Blue Life and Death Love, Oh! My Emperor and other film and television works.

Don’t try to disturb my study

Don’t try to disturb my study is a novel written by Yue Liuguang. The story tells the story that Nan Xiang, who has "academic discrimination", woke up late and returned to the second year of high school, but he changed from a bully to a scum, and gradually reversed his prejudice in the process of sprinting to a prestigious school.

It is understood that the drama series of the same name is directed by Chen Feihong and starring Vicky Chen and LAI KUAN LIN.

Biography of Yunxiang

The picture shows the cover of the novel Thousand Gates.

The costume drama "Biography of Yunxiang" prepared by Beijing Youth Hello Culture Media was officially established. The company has invested in the production of a large number of dramas, such as Si Mei Ren, Hot-blooded Companion, Records of Nanyanzhai, etc., and actors such as Liu Yifei, Jackson Yee, Jing Bo Ran and Viann have been its partners.

This time, Biography of Yunxiang is adapted from Fang Baiyu’s series of novels "Thousand Gates", which tells the story of Yunxiang’s decision to stand up and serve the country and the people after experiencing high spirits, betrayal and where will you go.

There are 7 novels in this series, each of which has a score of about 8 in Douban.

Fish jumps into the sea at this time

The picture shows the poster of the TV series "The Night"

"Fish jumps into the sea at this time, and flowers bloom on the other side of the sky." It is a line from the previous hit drama "The Night".From the synopsis, Fish Jumping into the Sea is based on the tricky novel Jiangye, and the producer is also the same company as Jiangye.

Attentive netizens found that the genre of "The Night" is "Ancient Myth", while the genre of this new drama is "Ancient Legend", so it is not difficult to guess that "Fish Jumping into the Sea" has removed the fantasy elements and added some new scenes.

However, the project of "Fish Jumping at this Time" still caused many netizens to discuss. Is this a remake or a sequel to "The Night"?

Rebel

The TV series "Rebel" jointly produced by iQiyi and Xinli has been approved.

The play is adapted from the award-winning work of the same name which won the first prize of People’s Literature Award, and was created by famous screenwriters Li Xiaoming and Qin Wen.It is understood that "The Rebel" stars Zhu Yilong and Tanya, and Wang Zhiwen, Wang Yang and Zhu Zhu will all join in.

The relationship between the characters in the original novel is complicated. In different revolutionary processes, such intelligence personnel as Lin Nansheng, Gu Shenyan, Lao Pan, Xu Yizhen, Ji Zhongyuan, etc., although they are their own masters, they cross each other, exchange information, and at the same time launch mutual struggle and counter-struggle … …The film and television of the novel began to be prepared last year, and it is expected to start shooting at the end of the month.

In addition, Dear Yourself, which was co-produced by Zhu Yilong and Liu Shishi, was also finished yesterday. I believe I will meet you soon!

This time, the Film Bureau handled 163 feature films and 22 animated films (there were 124 feature films and no animated films in the previous period).

From the data,The number of animated films has obviously increased, and the themes are mostly China traditional fairy tales.Including Ten Thousand Valleys in Hong Haier, The Classic of Mountains and Seas in the Goddess Chang’e flying to the moon, The Story of the Yellow Emperor, etc., which is related to the "Big Bang" and is more conducive to the spread of traditional culture to the next generation.

In addition, there is a "Ice Hockey Dream Path", which is a gift for the 2022 Winter Olympics."New furong town" and "Moses on the Plain" represent the film types of China, and this river is branching off to different river basins.

The performance of China’s literary films in recent years is enough to prove that they can be small and beautiful in their own fields.

In terms of TV dramas, Merit is the main theme, which is related to the frequent "big explosions" of the main theme in recent years.

Whether it’s My People,My Country in the movie or Peace Hotel and Ice-breaking Action in the TV series, it reflects the audience’s eternal enthusiasm for the main theme blockbuster.

A few years ago, the "big female drama" was all the rage.From the early "Invincible Ugly Woman" to recent yearsZhen XuanBiographyChu Qiao Biography, Hua Qiangu, etc. all revolve around the story of women’s growth and struggle.

And this trend is gradually broken by the mode of "double male masters" and "big male masters".Now, the establishment of Hua Qiangu and Farewell to Wei ‘an, together with The Legend of Fei’s Qing Hairpin Trip, Da Song Gong Ci and Emperor Huang Ye, which will be broadcast in 2020, also means the return of the works of "Big Lady".

However, the audience’s eyes are becoming more and more critical, and the return of the "big woman" does not mean re-entering the peak of the trend. It still depends on how to innovate in the "routine" and how to impress the audience again.

Judging from the filing items, both movies and TV series tend to favor the IP with fans already, and many projects are from original novels, movies or TV series, including the companion piece Dear, Dear and Joy of Life Animation Edition.This reflects the problem of over-reliance on existing IP and insufficient originality.

However, we also hope to see reasonable adaptation and innovation in new movies and plays.

There is no luck to win, only the accumulation of money and hard work is the foundation of permanence.

I hope that domestic films and domestic dramas will blossom and get better and better!

Toyota Corolla, as a classic model in the family, it can be said to have a certain status and influence. After all, since its launch, whether in our domestic market or overseas, it has benefited from its fuel-efficient, durable and worry-free characteristics. It has been well received by many car fans and friends. Even in the current highly competitive car market, it still has excellent sales performance, which can also reflect the popularity of the Corolla from the side. Recently, the editor learned from relevant channels that the 2023 Toyota Corolla has officially been launched overseas. In order to meet the needs of different consumers, the new car offers three models (sedan, hatchback and station wagon). Let’s follow the editor to find out.

It is worth mentioning that the Toyota Corolla in our domestic market only provide sedan options, the price range is: 10.98-15 9,800 yuan. The new Toyota Corolla (overseas version) sedan price: 199- 2.998 million yen (about RMB 9.76-14 7,100 yuan), hatchback version price of about RMB 10.79-14 1,800 yuan, travel version price of about RMB 10.15-14 9,500 yuan, for such a price range, do not know what you think? In terms of design, it is estimated that many friends see the picture above will think, is this not Jetta? Indeed, the use of a C-shaped logo makes it easy to give people the visual feel of a Jetta model. The exaggerated air intake grille on the front face has a great visual impact, and the sharp headlights on both sides, coupled with daytime running lights with LED light sources, give people a youthful and dynamic visual experience.

It is worth mentioning that in order to meet the aesthetic needs of different consumers, the new Toyota Corolla (overseas version) will also offer a variety of body colors to choose from. The sharp waistline of the side body is outlined, and the multi-spoke rims below add a certain degree of strength. As for the interior design, the new car does not look significantly different from our domestic Corolla models. The central control area layout is clear and regular, and certain physical buttons are retained. The floating LCD screen will also support functions such as mobile CarPlay and Wi-Fi networks, adding a bit of a sense of technology. In addition, the new car is also equipped with the Toyota Safety Sense 3.0 system, so it is naturally better in terms of safety performance. The three-frame multi-function steering wheel, with a slender stopper, and a large number of chrome-plated trim decorations enhance the overall sense of class.

In terms of power, the new Toyota Corolla (overseas version) will offer 1.5L/2.0L and 1.8L hybrid options to meet the needs of different consumers. Overall, the Toyota Corolla, as a classic model in the family, can be said to be a no-worry existence. If our domestic Corolla also offers hatchback versions and travel versions in the future, then it is estimated that sales will be further improved. What do you think about this? Welcome to communicate and discuss together below. (18/edit)

1905 movie network news Suspense thriller film (provisional translation) recently exposed the starring lineup. Hollywood power actors isabelle fuhrman (Orphan), Holland Roden (teen wolf and Zero Channel), India Moore (Posture), Thomas Conquer (Divorce Party) and Carlito Olivero (Dance Out of My Life: The Wave) joined us with surprise. Taylor Russell and Logan Miller, the former players, will also return and form a "Chamber of Secrets Players" with new members to challenge the upgraded deadly game again. The film will be released in North America on August 14th, 2020.

Poster of Escape from the Chamber of Secrets 1

"Horrible Lori" surprises to join, expecting new and old members to match sparks again and again

Escape Room: Tournament of Champions is still heavily supervised by Neal H. Moritz, the gold medal producer who created The Fast and the Furious series, Extreme Agents series and Prison Break, with Bragi F. Schut as the screenwriter and Adam Robitel as the director. Along with the behind-the-scenes masters of gold, Taylor Russell and Logan Miller in the previous works also returned. As a cutting-edge actress in Canada, Taylor Russell has an outstanding performance in Lost in the Sky and Suddenly Seven Days. And Logan Miller has been widely concerned and popular with Love, Simon and The Walking Dead. In Escape from the Chamber of Secrets, both their roles and performances left a deep impression on the fans.

Stills of "Escape from the Chamber of Secrets 1"

The new "players" include isabelle fuhrman, Holland Roden, India Moore, Thomas Conquer, Carlito Olivero and other powerful actors. Isabelle fuhrman was once dubbed "Horrible Loli" by fans for her amazing performance in Orphan, while other masters have made eye-catching performances in many popular American TV shows, which can be described as superior in strength and exciting. This lineup has doubled the confidence of many fans, and the voice of praise is endless: stable! Although the roles of the leading actors have not yet been announced, based on their solid acting skills, there is no doubt that there is a proper "spark after spark".

The sequel to the box office word-of-mouth double harvest of "Hard Movies" hit the appetite of fans.

The previous film beat a large number of blockbusters during its release in North America this year, becoming the box office dark horse second only to. After landing at the China Cinema on January 18th, it made a box office of 232 million, making it the highest-grossing imported suspense thriller in China. As a thriller, "Escape from the Chamber of Secrets" has achieved the effect of making the audience’s heart pounding without blood or ghosts. Its Douban score of 7.2 is also the best in thrillers in recent years. It is no wonder that some fans say that "the imagination and horror of the film are flying all the way, the IQ is slightly dropped, and life hangs up directly."

The movie "Escape from the Chamber of Secrets" tells the story of six strangers with different identities. In order to win high bonuses, they are invited to participate in the world’s top escape game from the Chamber of Secrets under the guidance of the mysterious box. Finding clues, defending people’s hearts and living have become everyone’s ultimate goal. This is a thrilling suspense story that combines closure, excitement and substitution. The script is strict in logic, the picture is tense and exciting, and there is no urine spot in the whole process, which is related to the theme of human nature … … It has become a hot topic for the audience. The plot trend of the sequel has not been exposed yet, but it has aroused many speculations from fans, which can be said to have enough appetite and undoubtedly make people expect more.

Escape Room: Tournament of Champions (tentative translation) was produced by American Columbia Film Company. Producer Neal H. Moritz, director Adam Robitel and screenwriter Bragi F. Schut "Golden Iron Triangle" joined hands again, and co-produced it with Taylor Russell, Logan Miller, isabelle fuhrman, Holland Roden, India Moore, Thomas Conquel and Carlito Olivero. The film will be released in North America on August 14th, 2020.

(Reporter Wei Yu Chunfeng) On the 28th, the Standing Committee of the Municipal Party Committee held a meeting to convey the spirit of the important speech made by General Secretary of the Supreme Leader during his inspection tour in Renmin University of China, and to study and deploy the implementation work in our city. Li Hongzhong, secretary of the Municipal Party Committee, presided over the meeting.

The meeting pointed out that on the eve of the May 4th Youth Day, the General Secretary of the Supreme Leader made an investigation and delivered an important speech at Renmin University of China, which fully reflected the great importance attached to education and the ardent expectations of the vast number of young people. We should conscientiously study and understand it and implement it in combination with the actual situation in our city. First, we should carry out the fundamental task of cultivating people by virtue, adhere to the guiding position of Marxism, continue to cultivate people with Socialism with Chinese characteristics Thought of the Supreme Leader in the new era, educate and guide teachers and students to deeply understand the decisive significance of the "two establishments", strengthen the "four consciousnesses", strengthen the "four self-confidences" and achieve the "two maintenances", and strive to educate people for the party and the country, and train builders and successors of the cause of socialism with Chinese characteristics. The second is to improve the quality and efficiency of ideological and political courses, promote the integration of ideological and political courses in universities, primary and secondary schools, innovate ways and means, and increase the attractiveness and pertinence of courses. Adhere to ideological and political courses and courses, and realize all-round education. Third, speed up the construction of philosophy and social sciences with China characteristics, adhere to China characteristics, China style and China style, combine the basic principles of Marxism with China’s concrete reality and the excellent traditional Chinese culture, give full play to the advantages of Tianjin philosophy and social sciences, keep up with the trend of the times, respond to practical concerns, and spread China voice, China theory and China thought. The fourth is to build a team of high-quality teachers.Education guides teachers to recognize their mission and responsibilities, consciously implement the party’s educational policy, always be loyal to the education cause of the party and the people, combine teaching and self-cultivation, and be determined to teach and educate people for life. Fifth, guide the vast number of young people to strive to be new people of the times who are worthy of the heavy responsibility of national rejuvenation. League organizations at all levels should do a solid job in contacting and serving young people. Colleges and universities should pay attention to strengthening young students’ social experience and practical exercise, and constantly enhance their sense of social responsibility and mission in the new era.

The meeting discussed the legislative plan of Tianjin Municipal People’s Government in 2022, and emphasized that the Party’s leadership should be implemented in all aspects of the whole process of government legislative work under the guidance of the supreme leader’s rule of law. It is necessary to establish a pragmatic and effective law, closely focus on the decision-making and deployment of the CPC Central Committee and the work of the Municipal Party Committee Center, and focus on improving the quality of legislation in key areas and emerging areas such as high-quality development, scientific and technological innovation, ecological civilization, social governance and people’s livelihood security. Do a good job in the implementation of the law, increase the publicity of the rule of law, and guide the broad masses to learn and know the law, consciously abide by the law, find the law when things go wrong, and rely on the law to solve problems.

The meeting discussed the management methods of star rating in Tianjin village community, community workers and full-time party workers in rural areas, and emphasized that we should stand on the height of consolidating the party’s ruling foundation at the grassroots level, comprehensively strengthen the party building at the grassroots level, consolidate the results of the village community grassroots organizations’ change, highlight the political functions of grassroots party organizations, strengthen the axis role of grassroots party organizations, and promote the party’s leadership to "stick a steel rod in the end". It is necessary to deepen the practical activities of "I do practical things for the masses" and enhance the ability of grassroots governance. Strengthen the care for grassroots cadres and establish the orientation of selecting and employing people at the grassroots level.

The meeting discussed the design scheme of Tianjin Cultural Center’s theme social publicity focusing on the core area, emphasizing the need to closely focus on the main line of welcoming, studying, propagating and implementing the 20th National Congress of the Communist Party of China, focusing on the historical achievements and changes in the cause of the Party and the state since the 18th National Congress of the Communist Party of China, focusing on the achievements of the city’s economic and social development, making full use of existing resources, embodying the characteristics of the times, and striving to create a bright spot for social publicity.

The meeting also studied other matters.

Sino-US trade friction has escalated again. Ignoring China’s sincere attitude and actions, the United States increased the tariff on China’s goods exported to the United States from 10% to 25% at 0: 01 Washington time on May 10, 2019. The Chinese side issued a statement at the same time, announcing that it had to take necessary countermeasures.

Faced with this regrettable situation, people who pay close attention to the progress made so far in the high-level economic and trade consultations between China and the United States have to ask: Is the United States fundamentally violating the negotiation principles of mutual respect, equality and mutual benefit, and is it trying to return the process of economic and trade consultations between China and the United States to the original point?

China has always believed that cooperation is the best choice and the only correct choice to solve the problem. Only by earnestly following the established principles and directions of the two sides, strengthening communication, focusing on cooperation and controlling differences can we promote the healthy and stable development of Sino-US economic and trade cooperation and bilateral relations.

The trend of Sino-US economic and trade relations is not only related to the two major economies, but also profoundly affects the world. In the face of a great change that has never happened in a century, economic globalization has suffered twists and turns and uncertainty has intensified. Where is the human society going? At present, American policy makers have made a big bet on the side of "fighting", which has obscured the vision of "getting benefits now", failed to grasp the historical laws, failed to recognize the general trend of the world, and did not want to shoulder the responsibility of the times, thus casting a shadow on the development prospects of the world.

(1)

The United States has launched trade friction offensives again and again, which not only loses its national reputation, but also seriously interferes with the Sino-US economic and trade consultation process.

Looking back on the trade friction between China and the United States, in March 2018, the United States unilaterally provoked the friction and escalated it in a short period of time, which adversely affected the economies of the two countries and global trade.

In order to avoid further escalation of friction, on December 1, last year, at the G20 Summit in Buenos Aires, Argentina, the heads of state of China and the United States reached an important consensus: expand cooperation on the basis of mutual benefit, control differences on the basis of mutual respect, and jointly promote Sino-US relations based on coordination, cooperation and stability.

Subsequently, the economic and trade teams of the two sides held a series of consultations and held dialogues around issues of common concern, such as trade balance, intellectual property protection and two-way investment, constantly expanding consensus, narrowing differences and making positive progress on a series of specific issues. China has always insisted on resolving differences through dialogue, always opened the door to negotiations, actively negotiated with the greatest patience and sincerity, and tried its best to seek the greatest common denominator of the interests of both sides.

However, regardless of China’s sincerity and actions, regardless of the principle of equality and mutual benefit, the United States has exerted extreme pressure and exorbitant prices, which has once again escalated Sino-US trade friction and cast a shadow over Sino-US economic and trade relations.

(2)

The unilateralism and hegemonism pursued by the United States have no way out, which has a serious negative impact on world economic growth and global trade.

As the main founder and participant of the international economic order and multilateral trading system after World War II, the United States should shoulder its due responsibilities, take the lead in observing multilateral trade rules, and properly handle trade frictions with other members through the dispute settlement mechanism under the framework of the WTO, which is also a clear commitment made by the US government to the international community. However, while enjoying the benefits brought by the current international trading system, the current American government has unilaterally exaggerated its domestic problems, internationalized domestic issues, politicized economic and trade issues, pursued extreme pragmatism, and even openly violated WTO rules, which has damaged its national image.

The sudden imposition of tariffs by the US government will inevitably cause great harm to the United States itself, which is a long-established consensus in American society. "My business, not China, paid the 25% tariff, which is imposing tariffs on American consumers." On American social media, there are many such objections. Rick Hefenbay, president of the American Apparel and Footwear Association, said that additional tariffs would only hurt American families, American workers, American companies and the American economy.

American farmers have also been hit. In 2018, the net agricultural income in the United States fell by 12%, and the prices of soybeans, pork, dairy products and wheat suffered a cliff-like decline. While profits fell, equipment prices rose. Lowe Nezl, the fourth-generation farmer of Bissmark Farm in Kansas, said that the farm has been experiencing "difficult economic times" since last year because of the tariff increase, and he and other farmers are victims of trade disputes. Jim Tapon, a grain farmer, said, "We survived the difficult times in the 1970s and 1980s, but we can’t survive now", and his family had to give up their farm after nearly 100 years of operation.

Moreover, the trade friction between the world’s two largest economies has aroused the international community’s concern about global economic growth. The International Monetary Fund, the World Bank and other institutions recently lowered their expectations for world economic growth. Lagarde, managing director of the International Monetary Fund, described the current world economic situation as "uncertain weather" and listed the trade issue as "the biggest uncertainty factor in the world". The WTO has lowered its global trade growth forecast for 2019 from 3.7% to 2.6%, the lowest level in three years.

The trade war can’t solve the problem, and the protectionist behavior of the United States has hurt the interests of American consumers, farmers, entrepreneurs and other groups and the global industrial chain. At present, the economic and political pressure in the United States is increasing, and it is difficult to bear the price of further escalation of trade friction. International public opinion believes that the United States can only finally return to the negotiating table and truly solve the problem through equal consultation. This is the only correct choice.

(3)

China adheres to principled cooperation and resolutely defends the core interests of the country and the fundamental interests of the people. We are confident, determined and capable of coping with risk challenges.

To solve the trade friction between China and the United States, China’s position has always been clear-"cooperation is the best choice for both sides." "We are willing to solve the economic and trade differences and frictions between the two sides in a cooperative way and promote an agreement acceptable to both sides."

Cooperation is principled, not just compromise. China will never develop itself at the expense of other countries’ interests, and will never give up its legitimate development rights and interests. Sino-US trade friction has occurred for more than a year, and its impact on China’s economy is generally controllable, whether it is macro-economy, enterprise development or people’s livelihood.

Long-term positive economic fundamentals are the fundamental support for us to cope with risk challenges.

Since the beginning of this year, in the face of the complicated and severe situation, China has unswervingly promoted high-quality development, made great efforts to deepen structural reform on the supply side, continued to fight three tough battles, timely and moderately implemented countercyclical adjustment of macroeconomic policies, kept major macroeconomic indicators within a reasonable range, significantly improved market confidence, and accelerated the implementation of the conversion of old and new kinetic energy. Looking at this year’s opening report card, China’s GDP increased by 6.4% year-on-year in the first quarter, which exceeded market expectations and remained in the range of 6.4%-6.8% for 14 consecutive quarters. More importantly, at the end of March, the national urban survey unemployment rate was 5.2%, the employment situation was generally stable, and the development "gold content" was higher and more sufficient.

"China does not want to fight a trade war, but it is not afraid to fight a trade war." Sino-US economic and trade issues have limited impact on China’s economic growth. In recent years, thanks to the huge market space and consumption upgrading potential, domestic demand has become the main engine of China’s economic growth, and the contribution rate of consumer demand to economic growth reached 76.2% last year. The impact of fluctuations in Sino-US economic and trade relations is also limited.

Over the past year or so, we have always maintained a high degree of vigilance. We have not only taken the lead in preventing risks, but also advanced measures to deal with and resolve risk challenges, and fought a strategic initiative to turn danger into opportunity. Measures to stabilize employment, finance, foreign trade, foreign investment, investment and expectations have been introduced intensively and landed solidly. China’s economy has shown a high score: the economic growth rate ranks first among the five major economies, with the total economic output exceeding 90 trillion yuan for the first time. The economic structure has been optimized and upgraded, and the pace of China’s steady and progressive economy has been forceful.

The unique advantages of the China system are our greatest confidence in coping with risk challenges.

The more complicated the situation is and the challenges are severe, the more we should give play to the role of the centralized and unified leadership of the CPC Central Committee. The closer we get to the goal of realizing the great rejuvenation of the Chinese nation, the more we need to closely unite around the CPC Central Committee with the supreme leader as the core, strengthen the "four consciousnesses", strengthen the "four self-confidences" and achieve the "two maintenances", which will not only enhance the sense of hardship, plan ahead, accurately judge and properly deal with possible major risks in the economic field; We will also maintain strategic strength, forge ahead, blaze new trails, and make unremitting efforts along the established grand goals.

It should be noted that the achievements of construction, reform and development in the 70 years since the founding of New China, especially the historic achievements and changes since the 18th National Congress of the Communist Party of China, have laid a solid foundation for us to properly deal with trade frictions. It is the fundamental way to deal with trade friction to develop and strengthen yourself through reform and opening up and concentrate on doing your own thing well. It should also be noted that the strong leadership of the CPC Central Committee, the superiority of China’s socialist system, the high degree of unity of national will and the close unity and strong support of the people of the whole country are our greatest advantages and fundamental guarantee for dealing with trade frictions. As the Chairman of the Supreme Leader declared: "The open door of China will not be closed, but will only grow wider and wider. China’s pace of opening up to a higher level will not stagnate! China’s efforts to build an open world economy will not stop! The pace of China’s promotion of building a community of human destiny will not stagnate! "

"There are many things in the world, and drums are used to urge the boat to be stable." Under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, we will certainly overcome all difficulties and obstacles on the road ahead, and no risk challenge can stop China’s progress!

(4)

Sino-American relations have gone through storms for 40 years and have always moved forward. The common interests between China and the United States are greater than differences, and the need for cooperation is greater than friction. Contradictions and differences should not be allowed to interfere with the current overall situation of Sino-US relations, and prejudice should not be allowed to misjudge the future trend of Sino-US relations.

"Looking at the distance, you can know that the wind and waves are small, and the sky begins to feel the sea level."

From the perspective of historical development, every major breakthrough in Sino-US economic and trade relations in the past 40 years has pushed bilateral relations to a new level; Every turn of Sino-US relations is inseparable from the "ballast stone" and "propeller" role of economic and trade relations. Today, although the respective situations of the two countries and the international situation have changed, both sides should remain determined and not be confused by one thing at a time or disturbed by one bureau and one territory.

From the actual demand, today, China and the United States have become each other’s largest trading partners and important investment targets. There is a flight taking off and landing every 17 minutes, and more than 14,000 people travel between the two sides of the Pacific Ocean every day. The annual bilateral trade volume of goods has increased from less than 2.5 billion US dollars to 630 billion US dollars … The interests in bilateral economic and trade cooperation have been expanding, and mutual dependence has been increasing, forming a pattern of "you have me and I have you". The two peoples have continuously deepened their understanding and benefited from it, which also confirms the profound truth that "cooperation is the only correct choice for China and the United States".

In all fairness, Sino-US economic and trade exchanges are huge in scale, rich in connotation, wide in coverage and involving multiple subjects, and it is inevitable that some contradictions and differences will arise. However, the interests of China and the United States are deeply blended and the market advantages are complementary. The economic and trade cooperation between the two countries is essentially mutually beneficial and win-win. Only by looking at it from a comprehensive perspective and starting from the overall situation of safeguarding the strategic interests of the two countries and the international order can we properly handle differences and resolve contradictions pragmatically.

From the perspective of non-governmental exchanges, the friendship between the two peoples has always been the source of the development of Sino-US relations. The friendly story of "Ping-Pong Diplomacy" is a much-told story among the people of the two countries. Disneyland settled in Shanghai; McDonald’s, KFC and Starbucks are all over China … Over the past 40 years, non-governmental exchanges between China and the United States have become more and more abundant, involving economy, trade, law, education, sports and many other fields. Today, 40 years later, only by conforming to the trend of the times, responding to the voice of the people, encouraging and supporting people from all walks of life in both countries to carry out exchanges and cooperation, can we promote the stable and far-reaching Sino-US relations.

Historical experience tells people that a prosperous China is beneficial to the United States, and a prosperous America is also beneficial to China. China has no intention of changing the United States or replacing it; The United States can’t control China, let alone stop the development of China. How China and the United States judge each other’s strategic intentions will directly affect what policies they adopt and what relations they develop. We can’t make mistakes on this fundamental issue, otherwise we will make all mistakes.

"The vast Pacific Ocean has enough space to accommodate the two great powers of China and the United States", "China and the United States share extensive and important common interests, and the combination of China and the United States will benefit both, and the fight will hurt both" and "there is no Thucydides Trap in the world" … A series of important expositions on Sino-US relations by the Chairman of the Supreme Leader show the profound grasp of the general trend of Sino-US relations and the responsibility of promoting the construction of a new type of relationship between major powers.

Standing at a new starting point, China and the United States need to enhance mutual trust, promote cooperation, manage differences and jointly promote Sino-US relations based on coordination, cooperation and stability. Only in this way can we be worthy of the strategic choice made by the two peoples 40 years ago and leave a better Sino-US relationship to future generations.

(5)

Tracing back to the source along the historical development, we can see the logic of progress. Examined in the overall pattern of China’s reform and opening up, trade friction is also a "stress test", which further strengthens our confidence and determination to comprehensively deepen reform and opening up.

Forty years ago, Time magazine of the United States questioned: Is there such a precedent for a quarter of the world’s population to quickly get rid of isolation and connect with the world?

Over the past 40 years, China has made a great leap from "crossing the river by feeling the stones" to "breaking a new path", using the golden key of reform and opening up to open the door to embrace the world. Today, China has become the world’s second largest economy, the largest commodity trading country and the largest foreign exchange reserve country, and has become a major trading partner of more than 120 countries and regions.

China is open in all directions and does not depend on one country or one region. The United States is China’s largest trading partner, but it is not the only one.

"China’s reform and opening up is the most successful economic reform movement in human history after World War II." Coase, the Nobel laureate in economics, came to this conclusion in his book Changing China.

When the door is opened, fresh air can come in, and wind and rain will also come in. All kinds of risk challenges cannot be avoided. This trade friction is not only a "master’s trick" between big countries, but also a challenge in the process of growth.

This is a test of the ability to withstand pressure. In the 40 years of reform and opening up, the strong potential energy accumulated by China’s development is a solid foundation for coping with the impact. China is the only country that has all the industrial categories of the United Nations industrial classification. The big market with a population of nearly 1.4 billion is thriving, and the abundant human capital is constantly flowing. Consumer demand has become the "first engine", and the fundamentals determine that China’s economy has strong resilience. "China’s economy is a sea, not a small pond." "Storms can overturn small ponds, but not the sea." The words of the Chairman of the Supreme Leader are forceful and hit the floor.

This is a test of economic vitality. What changes have taken place in China every minute? In Hubei, 12 Dongfeng cars were off the assembly line; In Henan, export food and agricultural products worth 48,000 yuan; In Liaoning Pilot Free Trade Zone, the registered capital is increased by 690,000 yuan … The scale of "one minute" makes people feel the vigorous pulse of China’s development. All vitality comes from reform and opening up. In the process of striding towards the world, enterprises in China have waded through water, encountered whirlpools and encountered storms, but learned to swim in swimming. Today, the deepening of reform is frequent and unprecedented, and a series of measures, such as promoting the "streamline administration, delegate power, strengthen regulation and improve services" reform and reducing taxes and fees on a large scale, have released the innovation and entrepreneurship of more than 100 million market players to the maximum extent.

This is a test of the quality of development. Trade friction is also a cold bath, which makes us more aware of the structural shortcomings. Small chips have become China’s largest imported goods; The output of more than 220 major industrial products is leading all the year round, but many of them are just sweat and resources. This also taught us a good lesson: China can’t buy a modernization, nor can it afford one. At present, the worldwide structural competition has begun to seize the commanding heights of a new round of industrial transformation. We must deepen the supply-side structural reform, speed up the optimization of the economic structure, promote quality reform, efficiency reform and power reform, and provide inexhaustible power for high-quality development.

Coming from challenges again and again, China became more aware of where he came from and where he was going. Reform and opening up is the only way and the key measure. In today’s China, with the deepening of reform and opening-up in an all-round way, the answer of "change or not" is firmer, and the path of "what to change" and "how to change" is clearer. Facing the problem of insufficient imbalance in development, we should give impetus to reform and opening up, and it is becoming an unshakable goal for China today to change from "have" to "be good".

Reform and opening up is only carried out when it is not completed. Since the reform and opening-up, we have blazed a new and good road with the courage of daring and self-innovation and ushered in a bright future of national rejuvenation. Striving for a new era and starting a new journey, as the Supreme Leader General Secretary solemnly declared on the 40th anniversary of reform and opening up: "China’s reform and opening up will never stop! China in the next 40 years will surely have new achievements that will impress the world! "

(6)

At a higher level, economic globalization is an irreversible historical trend. "It is impossible and against the historical trend to let the sea of the world economy return to isolated small lakes and rivers."

In April 2019, Beijing was full of spring, which witnessed another important historical node.

"As long as everyone in Qi Xin works together and helps each other, even if they are separated by thousands of waters and Qian Shan, they will certainly be able to walk out of a mutually beneficial and win-win road." The initiative put forward by the Chairman of the Supreme Leader in the keynote speech at the opening ceremony of the second "Belt and Road" international cooperation summit forum represents the common pursuit of mankind and has aroused strong resonance in the international community. Thirty-nine foreign leaders, more than 150 countries, 92 international organizations and nearly 6,000 foreign guests attended the meeting. The forum reached a series of cooperation consensus and formed a series of pragmatic achievements, reflecting the international influence, moral appeal and cooperation attraction of the "Belt and Road".

The initiative originated in China, and the opportunity belongs to the world. This is not a private path, but sunshine avenue, where everyone is advancing hand in hand: In Serbia, the Smederevo Steel Plant of Hegang Group has become the largest export enterprise, and the local unemployment rate has dropped sharply. "A steel plant is reborn and a city is happy"; In Maldives, the cross-sea bridge connects the islands; In the Republic of Montenegro, highways run through mountains; In Belarus, there is a car manufacturing industry … This is a fruitful achievement of the "Belt and Road" construction and a benefit brought by economic globalization to people of all countries.

What is economic globalization? Mobile phone production is a vivid epitome. A small mobile phone may have chips from Broadcom in the United States, image sensors from Sony in Japan, screen glass from Lansi Technology in China, flexible screen from BOE in China, etc. Parts from more than 200 suppliers from all over the world have crossed the ocean, flooded into Shenzhen, China and other places to complete production, and then delivered to consumers all over the world. It can be said that without goods, capital, technology and information flowing across borders, there would be no smart phone that everyone can’t live without.

The tide of economic globalization is rolling forward, but protectionism and unilateralism have cast a shadow over the world economic growth, and mankind has once again stood at a "crossroads." "Wise men make timely plans." At this time, China unswervingly pursues the win-win opening-up strategy, promotes the construction of an open world economy, leads the process of economic globalization, injects more certainty into the uncertain world, and conveys China’s confidence and China’s strength to the world-China has always been a builder of world peace, a contributor to global development and a defender of the international order.

"All roads lead to Beijing." Some overseas media commented. This "development pole" raised by the East has approached the center of the world stage and its weight is getting heavier and heavier. The contribution rate of China’s economy to world economic growth has been above 30% for many years, and it is the main stabilizer and power source of world economic growth. In the future, the development of China will also depict the direction of the world. The United States "World Post" once asserted that the future development of China’s economy will have a potential impact on everyone on the earth.

Being in a neighboring "global village", the development of China today is no longer a calm "inland river", but a "world ocean current" that blends with the global economy and is deeply integrated into the world economic chain. It is the aspiration of the people and the general trend to build a community of destiny and win-win cooperation.

The vastness of the sea lies in its open and inclusive mind. Today’s opening of China is not only the self-development of peers in the world, but also the initiative to lead the trend. China is a staunch defender of the multilateral trading system, a committed practitioner of opening wider to the outside world and an active advocate of building a community of human destiny. China is duty-bound to join hands with other countries to build a cooperation platform and achieve win-win sharing.

"If the world is good, China can be good; China is good, and the world is better. " The simple words of the Chairman of the Supreme Leader reveal the great logic of the relationship between China and the world in the new era. China’s wisdom is like a lighthouse in the sea, guiding the ships of the world economy to keep moving forward.

(7)

Standing on a longer time axis, the rise of a big country will inevitably go through a ditch. The key is to maintain strategic strength and strategic endurance and concentrate on doing your own thing well.

Emerging countries, from big to strong, all experience a special historical stage of increasing risks and challenges. China today is at such a "critical stage". Such a large volume and such a heavy weight can’t be hidden by "low-key", just as an elephant can’t hide behind a small tree, and it is inevitable to encounter a ditch.

"Ditch" and "hurdle" can’t control the "time" and "potential" of the development of things. Today’s world faces risks and challenges, but peace and development are still the theme of the times. As the world’s largest population country and the second largest economy, China plays an irreplaceable role in solving various world problems, and the dependence of countries on the China market has increased in an all-round way. China’s development is still in an important period of strategic opportunities, and the times and trends are on our side.

There is no golden age of enjoying the success. Just like a Mercedes-Benz train, once the power system stops, it can run for a while by inertia, but it will eventually stop. The great rejuvenation of the Chinese nation can never be achieved easily by beating gongs and drums. We must be prepared to make more arduous and arduous efforts. Today’s China is made by all the people; China in the future will depend on all the people to roll up their sleeves and work hard!

To do our own thing well, we should live up to the times and forge ahead.

The more critical it is, the more it is necessary to maintain strategic strength and firm confidence in winning. China’s economic fundamentals are full of confidence, and China’s institutional advantages are unparalleled. With the strong leadership of the CPC Central Committee with the Supreme Leader as the core and the leadership at the helm, we will never get lost because of the temporary storms. Stand firm in your own direction and follow your own path. China, a great ship, will break the waves and make steady progress!

To do our own thing well, we should follow the trend and overcome difficulties.

The more difficult and dangerous it is, the more we must enhance our sense of urgency and move towards high-quality development with greater political courage and wisdom. Development is the last word, and strength is the right to speak. Whether it is to resolve structural contradictions or to guard against cyclical risks, comprehensively deepening reform is the golden key. The shackles of ideas and concepts are being broken, the barriers of solidification of interests are being broken, the fetters of institutional mechanisms are being broken, and the reform and opening up are fully exerted. The Chinese nation is running out of the acceleration of the new era.

"The thunder in the storm is particularly loud, and the lightning in the depths of the dark clouds is particularly bright. Only through the long night can the fiery red sun spew out." The poem "Ode to Light" written by the poet Ai Qing symbolizes the indomitable and brave spirit of the strugglers.