After this point in time, WeChat scan code payment is limited! Can’t exceed …

guide reading

Do you know that?/You know what? Using WeChat, Alipay and other applications to scan the code payment will officially usher in the quota limit! Recently, there is a saying on the Internet that WeChat can withdraw cash for free. Is it true?

Attention! The central bank will take the shot and scan the code to pay the limit!

According to the notice of the central bank, from this yearApril 1st.Start, useWechat, AlipayThe application of scanning code payment will officially usher in the limit.

1. Static barcode payment: the limit is 500 yuan.

Our common roadside stalls, food markets, grocery stores, etc. posted on the wall or printed QR codes belong to static barcodes.

Because it is easy to be tampered with and carry Trojans or viruses, the payment risk is the highest and the risk prevention level is the lowest, which is D-level. No matter what transaction verification method is used, the cumulative transaction amount of a single bank account or all payment accounts and express payment of the same customer shall not exceed that of 500 yuan.

2. Dynamic code scanning payment: the limit is divided into three levels.

When we pay for things after shopping, it is a dynamic bar code to show the payment code for the cashier to scan.

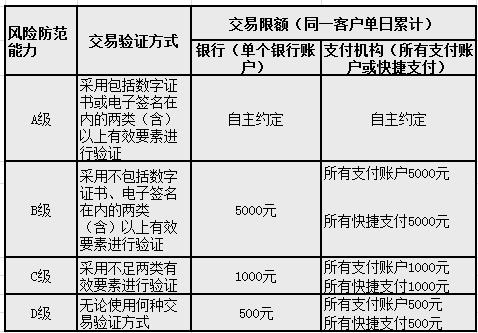

For payment with dynamic bar code, the risk prevention ability can be divided into three levels according to different transaction verification methods: A, B and C, and the cumulative transaction limit of the same customer per day is self-agreed, 5,000 yuan and 1000 yuan respectively.

Self-agreed quota:

The limit of 5000 yuan:

Limit 1000 yuan’s:

Kang Lin, deputy secretary-general of the China Payment and Clearing Association, said that Alipay and WeChat, which we use every day, generally use more than two elements, such as fingerprints and passwords, and the daily limit is 5,000 yuan.

The details are as follows:

What if the consumption exceeds that of 500 yuan?

Impact of quota on consumers:

Many people will ask whether after the implementation of the new regulations, payment by WeChat or Alipay can only cost 500 yuan every day. Actually, that’s not the case.

For example, if you eat a big meal in 600 yuan in a restaurant, it will be difficult to scan the static barcode for payment. At this time, the cashier can scan the dynamic barcode generated on the consumer’s mobile phone, which is safer.

Impact of quota on stores:

After the implementation of the new regulations, it may have some impact on small businesses on the street. For example, for the boss who sells pancakes, after the daily income exceeds that of 500 yuan, he needs to scan the code of each customer separately, which will bring some inconvenience if he meets an office worker who is in a hurry.

In addition, if the daily income exceeds that of 500 yuan, these stores need to prepare their own equipment such as scanners, which may add some pressure to small businesses.

Can wechat cash withdrawal be free? The truth is, …

In addition to the limit of scanning code payment, the handling fee for WeChat cash withdrawal has also received attention recently.

Nowadays, many people are used to transferring money and paying back money to WeChat or Alipay accounts, but there is a certain percentage of handling fee for withdrawing money. Recently, there is a saying on the Internet that WeChat can withdraw cash for free. Is it true?

Wechat has a free cash withdrawal trick: official receipt code.

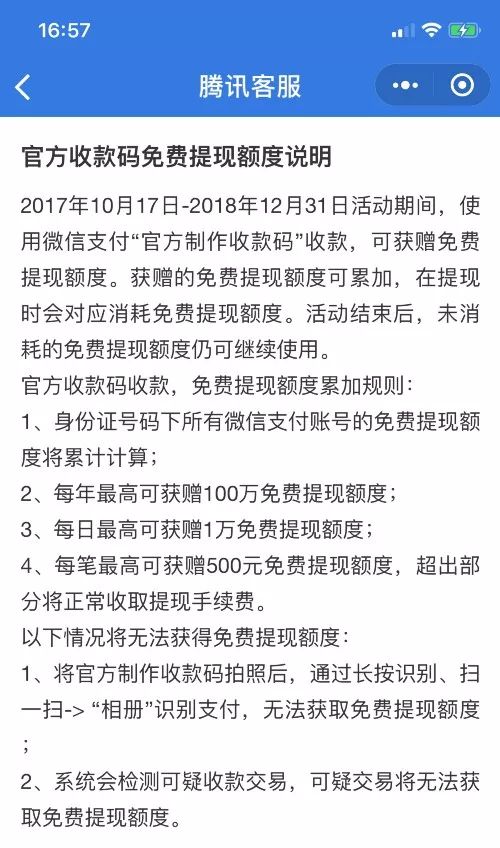

According to Tencent’s customer service information, as of December 31, 2018, merchants use the "official collection code" to collect money, which can accumulate the free withdrawal amount.

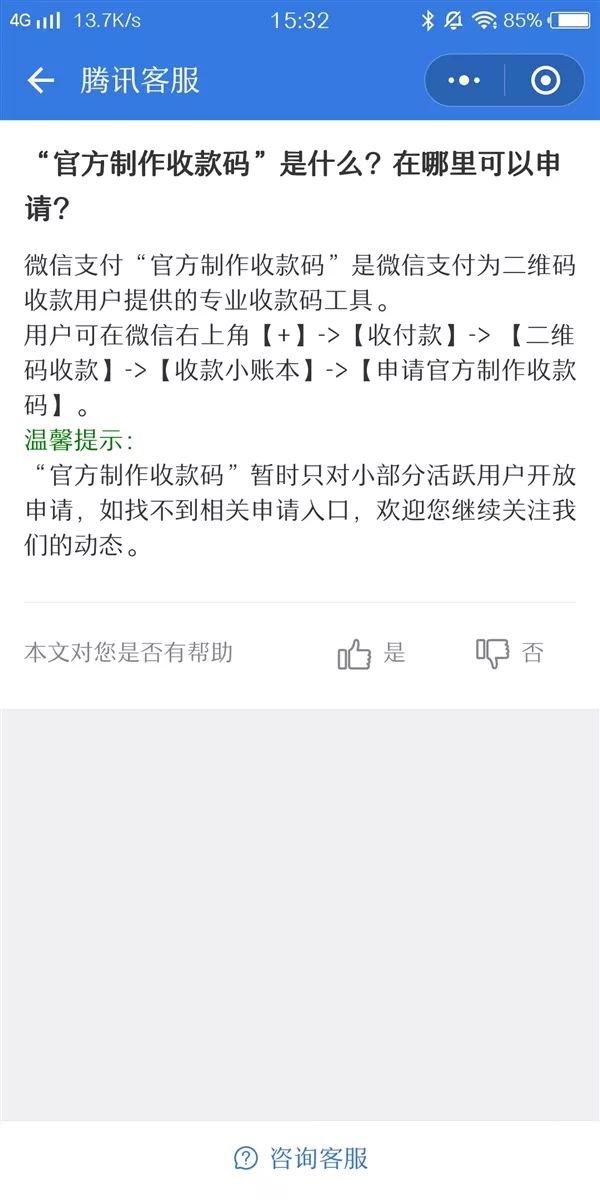

It is reported that the official receipt code of WeChat payment is a professional receipt code tool provided by WeChat payment for QR code collection users. The maximum daily limit is 10,000 yuan, and the maximum single withdrawal is 500 yuan.

Note that this is a professional collection code tool for QR code collection users, not all users!

How to apply for an official receipt code?

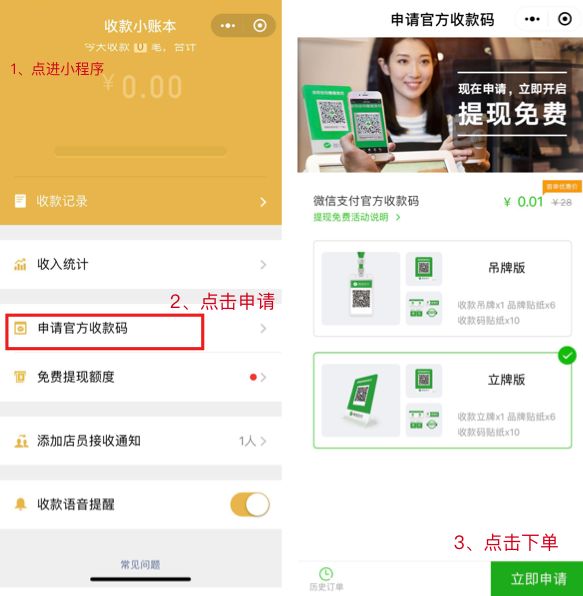

If Tencent opens the entrance for you, click "Apply for official receipt code" in the red box in the first picture below.

Choose a style and apply for an order of 0.01 yuan.

It should be noted that the official receipt code is not open to all users. This code is open to small businesses, that is to say, WeChat will be based on — — Your ordinary collection QR code, the number of days, the number of transactions and the amount, consider whether to give you the qualification of "official collection code".

Recently, there is a saying circulating on the Internet that some measures can be adopted to allow ordinary individuals to enjoy this kind of treatment that was originally only for small businesses. However, Tencent professionals said that these so-called methods are not credible, so don’t be fooled!

Is it reliable to realize free cash withdrawal from credit card overpayment?

There is also a saying circulating on the Internet that credit card overpayment transfer method can be used to avoid the withdrawal fee. For example, your credit card owes a total of 2,500 yuan, and you repay 3,000 yuan in it, so the extra 500 yuan is overpaid, and for most banks, there is no handling fee for overpaying cash withdrawal.

However, with this method, the most important thing is that you have a free credit card for overpayment. One thing to note here is that not all bank credit cards can withdraw the overpayment for free.

Financial experts remind that although the clever use of "overpayment" can save a certain handling fee, the cardholder needs to determine the number of "overpayment" in his card. If it is "overdraft cash withdrawal", it is possible to pay the handling fee and pay an interest.

In addition, banks also have certain restrictions on the amount of free cash withdrawal for credit card overpayments. I suggest you call the customer service of your bank first, and ask clearly before withdrawing cash.

Everyone must pay attention! Tell your relatives and friends!